Home

Home

Back

Back

Definition: The Millionaire Calculator estimates the time required to reach a financial goal, such as $1,000,000, by factoring in current savings, annual deposits, interest rate, and inflation, using compound interest with regular contributions. It also calculates the future purchasing power of the goal amount.

Purpose: This tool helps individuals plan their savings strategy to achieve significant financial milestones, providing a timeline and insight into the real value of their savings after inflation.

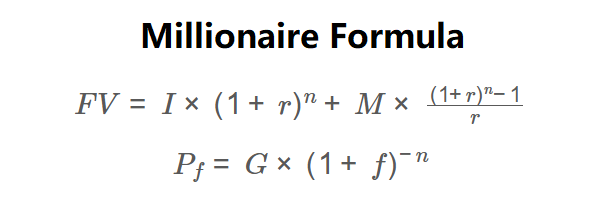

The calculator uses the following formulas:

\( FV = I \times (1 + r)^n + M \times \frac{(1 + r)^n - 1}{r} \)

\( P_f = G \times (1 + f)^{-n} \)

Where:

Steps:

Calculating the time to reach a financial goal is essential for:

Example: Calculate the time to save $1,000,000 with $10,000 current savings, $10,000 annual deposits, 5% interest rate, and 2% inflation rate:

Q: What is the Millionaire Calculator?

A: It calculates the time needed to reach a financial goal, like $1,000,000, factoring in current savings, annual deposits, interest, and inflation effects

Q: Why include inflation in the calculation?

A: Inflation reduces the purchasing power of money over time, and the calculator shows the real value of your goal in future terms.

Q: How can I reach my goal faster?

A: Increase annual deposits, seek higher interest rates through investments, or reduce the financial goal to shorten the required duration.