1. What is the Gold Melt Value Calculator?

Definition: The Gold Melt Value Calculator estimates the intrinsic value of gold items, such as jewelry or coins, based on their weight, purity (determined by karat), and current market price, assuming the gold is melted down. It also calculates bid and ask prices using a spread percentage.

Purpose: This tool helps individuals assess the melt value of gold possessions and estimate potential buying or selling prices, aiding in financial decisions like trading, selling, or valuing gold items.

2. How Does the Calculator Work?

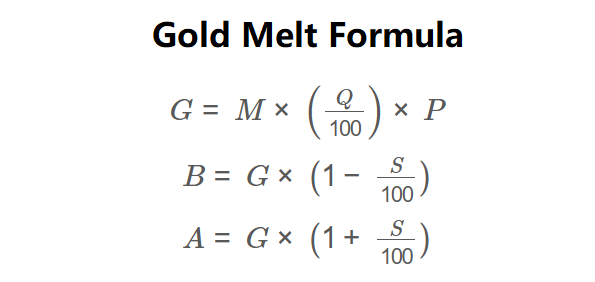

The calculator uses the following formulas:

\( G = M \times \left( \frac{Q}{100} \right) \times P \)

\( B = G \times \left(1 - \frac{S}{100}\right) \)

\( A = G \times \left(1 + \frac{S}{100}\right) \)

Where:

- \( G \): Possession value ($);

- \( M \): Weight of gold (troy ounces);

- \( Q \): Purity of gold (percentage based on karat);

- \( P \): Market price ($ per troy ounce);

- \( B \): Bid price ($);

- \( A \): Ask price ($);

- \( S \): Spread (percentage).

Steps:

- Enter the weight of the gold in troy ounces.

- Select the karat from the dropdown, which corresponds to a purity percentage (e.g., 22K = 91.67%).

- Enter the current market price per troy ounce of gold.

- Enter the spread percentage to calculate bid and ask prices.

- Calculate the possession value by multiplying weight, purity (as a decimal), and market price.

- Calculate bid price by reducing possession value by the spread percentage, and ask price by increasing it by the spread percentage.

- Display results in currency format with two decimal places.

3. Importance of the Gold Melt Value Calculation

Calculating the gold melt value is essential for:

- Financial Assessment: Provides an objective measure of gold’s intrinsic worth, useful for selling or insuring items.

- Market Transactions: Helps estimate bid and ask prices, informing buying or selling decisions in gold markets.

- Investment Planning: Assists in evaluating gold as part of a portfolio, focusing on its base value rather than aesthetic or collectible factors.

4. Using the Calculator

Example: Calculate the melt value of a gold coin with 1.0909 troy ounces, 22 karat purity (91.67%), $1,915 market price per troy ounce, and 5% spread:

- Weight: 1.0909 troy ounces;

- Karat: 22K (91.67% purity);

- Market Price: $1,915 per troy ounce;

- Spread: 5%;

- Possession Value: \( 1.0909 \times \left( \frac{91.67}{100} \right) \times 1,915 = 1.0909 \times 0.9167 \times 1,915 \approx 1,915.05 \);

- Bid Price: \( 1,915.05 \times (1 - 0.05) = 1,915.05 \times 0.95 \approx 1,819.30 \);

- Ask Price: \( 1,915.05 \times (1 + 0.05) = 1,915.05 \times 1.05 \approx 2,010.80 \);

- Result: Possession Value: $1,915.05; Bid Price: $1,819.30; Ask Price: $2,010.80.

5. Frequently Asked Questions (FAQ)

Q: What is gold melt value?

A: Gold melt value is the intrinsic worth of gold items based on their weight, purity, and current market price, assuming the gold is melted down.

Q: What does spread represent?

A: Spread is the percentage difference between the bid price (what buyers offer) and ask price (what sellers demand), reflecting market transaction costs.

Q: Why use karat instead of purity percentage?

A: Karat is a standard measure of gold purity, with predefined percentages (e.g., 22K = 91.67%), simplifying input for users familiar with jewelry standards.

Gold Melt Value Calculator© - All Rights Reserved 2025

Home

Home

Back

Back