Home

Home

Back

Back

Definition: The Emergency Fund Calculator estimates the amount needed for an emergency fund by multiplying monthly expenses by the desired number of months of savings, providing a financial cushion for unexpected events.

Purpose: This tool helps individuals plan a savings buffer to cover living expenses during emergencies like job loss or medical costs, ensuring financial stability without relying on debt.

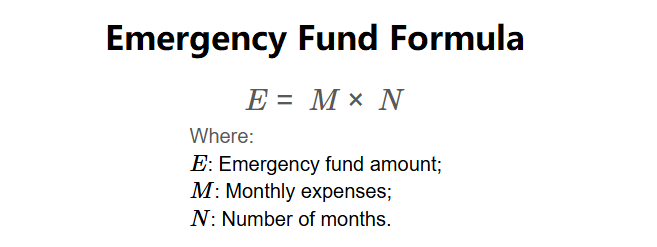

The calculator uses the following formula:

\( E = M \times N \)

Where:

Steps:

Calculating an emergency fund is essential for:

Example: Calculate an emergency fund for $2,500 monthly expenses and 6 months of savings:

Example 2: Calculate an emergency fund for $3,000 monthly expenses and 3 months of savings:

Q: What is an emergency fund?

A: An emergency fund is a savings reserve to cover living expenses during unexpected events like job loss, medical emergencies, or major repairs.

Q: How many months should I save for?

A: Financial experts recommend 3–6 months of expenses, though this varies based on income stability and risk factors (e.g., 6–12 months for freelancers).

Q: Why is an emergency fund important?

A: It provides financial security, prevents debt accumulation during crises, and supports long-term financial planning by ensuring a buffer for unforeseen expenses.