Home

Home

Back

Back

Definition: The Dream Come True Calculator estimates the time required to save for a financial goal, such as purchasing a dream item or experience, by considering the goal price, initial savings, monthly savings contributions, and annual interest rate with monthly compounding.

Purpose: This tool helps individuals plan their savings strategy, providing a realistic timeline to achieve their dreams while accounting for compound interest, enabling informed financial decisions.

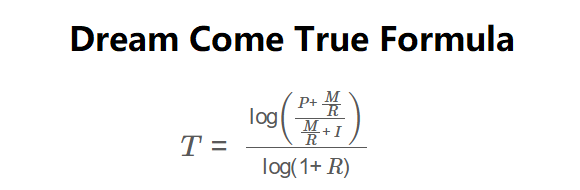

The calculator uses the following formula:

\( T = \frac{\log\left(\frac{P + \frac{M}{R}}{\frac{M}{R} + I}\right)}{\log(1 + R)} \)

Where:

Steps:

Calculating the time to reach a savings goal is essential for:

Example: Calculate the time to save for a $33,000 dream (e.g., a car) with a $5,000 initial savings, $1,500 monthly savings, and 5% annual interest rate:

Q: What is the Dream Come True Calculator?

A: It calculates the time needed to save for a financial goal, factoring in initial savings, monthly contributions, and compound interest.

Q: Why include interest in the calculation?

A: Interest, compounded monthly, accelerates savings growth, reducing the time needed to reach the goal.

Q: How can I shorten the time to reach my dream?

A: Increase monthly savings, choose a higher-yield savings account, or start with a larger initial savings to reduce the required saving period.