Home

Home

Back

Back

Definition: The Boat Loan Calculator computes the monthly payment and total interest cost for a boat loan, accounting for the loan amount, interest rate, and loan term. The loan amount is determined by the boat price, cash available, trade-in value, and sales tax.

Purpose: This tool helps individuals plan boat purchases by estimating affordable monthly payments and understanding the total cost of borrowing, aiding in budgeting and financial decision-making.

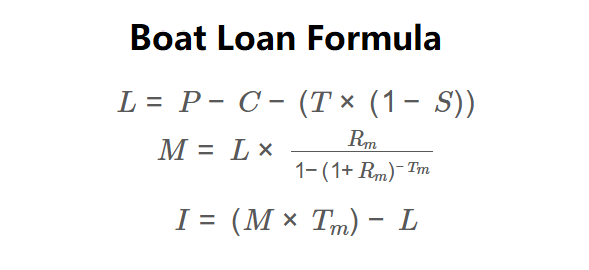

The calculator uses the following formulas:

\( L = P - C - (T \times (1 - S)) \)

\( M = L \times \frac{R_m}{1 - (1 + R_m)^{-T_m}} \)

\( I = (M \times T_m) - L \)

Where:

Steps:

Calculating boat loan payments is essential for:

Example: Calculate the loan for a $20,000 boat, with $1,500 cash, $7,000 trade-in value, 10% sales tax, 4% interest rate, and 36-month term:

Q: What is a boat loan?

A: A boat loan is a loan used to purchase a vessel, repaid in monthly installments with interest over a set term.

Q: How does sales tax affect the loan?

A: Sales tax reduces the net trade-in value, increasing the loan amount needed if not covered by cash or trade-in.

Q: Can I lower my monthly payment?

A: Yes, by increasing cash down payment, trading in a higher-value boat, choosing a lower interest rate, or extending the loan term (though this increases total interest).