1. What is the 529 College Savings Calculator?

Definition: The 529 College Savings Calculator estimates the future cost of college and the required monthly contributions to a 529 plan to cover those costs, accounting for inflation, investment returns, and annual withdrawals during college years. A 529 plan is a tax-advantaged savings account designed for education expenses.

Purpose: This tool helps parents plan for rising college costs, determine if their savings strategy is sufficient, and avoid large student loans by leveraging tax-free growth in a 529 plan.

2. How Does the Calculator Work?

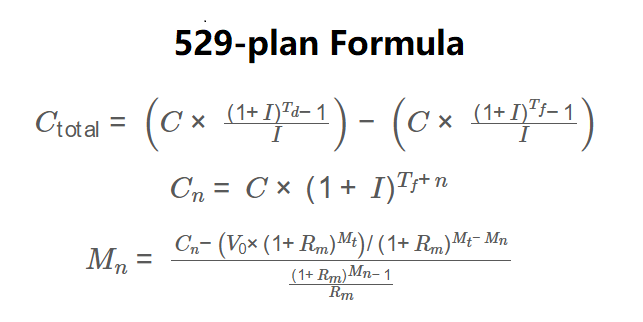

The calculator uses the following steps and formulas:

Step 1: Calculate Total College Cost

\( C_{\text{total}} = \left( C \times \frac{(1 + I)^{T_d} - 1}{I} \right) - \left( C \times \frac{(1 + I)^{T_f} - 1}{I} \right) \)

Step 2: Calculate Cost for Each College Year

\( C_n = C \times (1 + I)^{T_f + n} \)

Step 3: Calculate Required Monthly Contribution

\( M_n = \frac{C_n - \left( V_0 \times (1 + R_m)^{M_t} \right) / (1 + R_m)^{M_t - M_n}}{\frac{(1 + R_m)^{M_n} - 1}{R_m}} \)

Where:

- \( C \): Current annual college cost;

- \( I \): Inflation rate;

- \( T_d \): Years to deposit (\( T_f + \text{college years} \));

- \( T_f \): Years to first college year (\( \text{college age} - \text{current age} \));

- \( C_n \): Cost for \( n \)-th college year;

- \( V_0 \): Initial investment;

- \( R_m \): Monthly interest rate (\( \text{annual return} / 12 \));

- \( M_t \): Total months (\( T_d \times 12 \));

- \( M_n \): Months to \( n \)-th year (\( (T_f + n) \times 12 \));

- \( M_n \): Required contribution for \( n \)-th year.

Steps:

- Enter the child’s current age, college start age, and number of college years.

- Enter the current annual college cost and education cost inflation rate.

- Enter the initial investment and expected annual investment return.

- Calculate the total college cost over the college years, adjusted for inflation.

- Calculate the required monthly contribution to meet each year’s cost, considering the initial investment’s growth and annual withdrawals.

- Display the total college cost and required monthly contribution in currency format.

3. Importance of the 529 Plan Calculator

Calculating 529 plan contributions is essential for:

- Cost Planning: Accounts for rising education costs due to inflation, ensuring sufficient savings.

- Tax Advantages: 529 plans offer tax-free growth and withdrawals for qualified education expenses, maximizing savings compared to taxable accounts.

- Debt Reduction: Helps avoid large student loans by planning savings early, reducing future financial burdens.

4. Using the Calculator

Example: Calculate the required contribution for a 5-year-old child starting college at 18, with a 4-year degree, $12,000 current annual cost, 4% inflation, $1,000 initial investment, and 8% annual return:

- Current Age: 5; College Age: 18; College Years: 4;

- Years to First Year: \( 18 - 5 = 13 \); Years to Deposit: \( 13 + 4 = 17 \);

- Current Cost: $12,000; Inflation: 4%; Initial Investment: $1,000; Return: 8%;

- Total College Cost: \( \left( 12,000 \times \frac{1.04^{17} - 1}{0.04} \right) - \left( 12,000 \times \frac{1.04^{13} - 1}{0.04} \right) = 284,370.15 - 199,522.05 = 84,848.10 \);

- Cost Year 1: \( 12,000 \times 1.04^{13} = 19,980.88 \); Year 2: \( 12,000 \times 1.04^{14} = 20,780.12 \); Year 3: \( 12,000 \times 1.04^{15} = 21,611.32 \); Year 4: \( 12,000 \times 1.04^{16} = 22,475.77 \);

- Monthly Interest: \( 0.08 / 12 = 0.0067 \); Total Months: \( 17 \times 12 = 204 \);

- Contributions: Year 1: $52.28; Year 2: $48.84; Year 3: $45.80; Year 4: $43.07;

- Total Required Contribution: \( 52.28 + 48.84 + 45.80 + 43.07 = 189.98 \) monthly;

- Result: Total Cost: $84,848.10; Required Monthly Contribution: $189.98.

Since $3,000 annually ($250/month) exceeds $189.98/month, the planned savings are sufficient, with an extra $60.02/month.

5. Frequently Asked Questions (FAQ)

Q: What is a 529 plan?

A: A 529 plan is a tax-advantaged savings account for education expenses, offering tax-free growth and withdrawals for qualified costs like tuition and fees.

Q: How does inflation affect college savings?

A: Inflation increases future college costs, requiring higher savings. The calculator adjusts costs using the provided inflation rate (e.g., 4%).

Q: Can 529 funds be used for non-college expenses?

A: Yes, but non-qualified withdrawals incur taxes and a 10% penalty on earnings, so funds should be used for education to maximize benefits.

529 College Savings Calculator© - All Rights Reserved 2025

Home

Home

Back

Back