Home

Home

Back

Back

Definition: This calculator computes the yield to call (YTC) for a callable bond, representing the annualized return an investor would earn if the bond is called before maturity.

Purpose: Assists bond investors in evaluating the potential return of a callable bond, aiding in investment decisions and portfolio management.

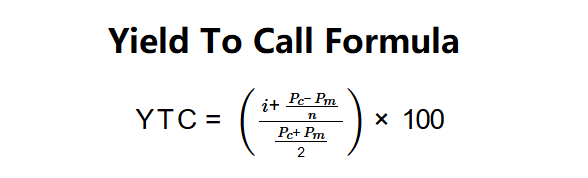

The calculator uses the following formula to compute the yield to call:

Formula:

Steps:

Calculating yield to call is crucial for:

Example: \( i = \$21.00 \), \( P_c = \$150,000.00 \), \( P_m = \$32,000.00 \), \( n = 7 \):

This result indicates that an investor would earn an annualized return of approximately 18.547% if the bond is called in 7 years.

Q: What does a high YTC indicate?

A: A high YTC suggests a higher potential return if the bond is called, often due to a significant difference between the call price and market price.

Q: How is the annual interest determined?

A: It’s the annual coupon payment, specified in the bond’s terms, typically based on the bond’s face value and coupon rate.

Q: Can YTC be negative?

A: Yes, if the bond’s market price is significantly higher than the call price plus interest, though this is rare.