1. What is the Working Capital Turnover Ratio Calculator?

Definition: This calculator computes the working capital turnover ratio (\( WCTR \)), which measures how efficiently a company uses its working capital to generate revenue, along with average current assets (\( ACA \)), average current liabilities (\( ACL \)), and average working capital (\( AWC \)).

Purpose: Helps businesses and investors assess operational efficiency, manage liquidity, and compare performance across companies or industries.

2. How Does the Calculator Work?

The calculator follows a four-step process to compute \( WCTR \):

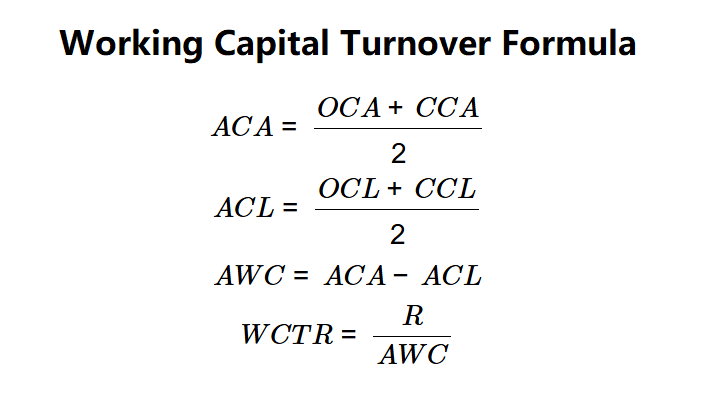

Formulas:

$$ ACA = \frac{OCA + CCA}{2} $$

$$ ACL = \frac{OCL + CCL}{2} $$

$$ AWC = ACA - ACL $$

$$ WCTR = \frac{R}{AWC} $$

Where:

- \( WCTR \): Working Capital Turnover Ratio (times)

- \( ACA \): Average Current Assets (dollars)

- \( ACL \): Average Current Liabilities (dollars)

- \( AWC \): Average Working Capital (dollars)

- \( R \): Revenue (dollars)

- \( OCA \): Opening Current Assets (dollars)

- \( CCA \): Closing Current Assets (dollars)

- \( OCL \): Opening Current Liabilities (dollars)

- \( CCL \): Closing Current Liabilities (dollars)

Steps:

- Step 1: Determine \( R \). Input the revenue from the income statement.

- Step 2: Determine \( OCA \) and \( CCA \). Input the opening and closing current assets from the balance sheet.

- Step 3: Determine \( OCL \) and \( CCL \). Input the opening and closing current liabilities from the balance sheet.

- Step 4: Calculate \( ACA \) and \( ACL \). Average the opening and closing values for assets and liabilities.

- Step 5: Calculate \( AWC \). Subtract \( ACL \) from \( ACA \).

- Step 6: Calculate \( WCTR \). Divide \( R \) by \( AWC \).

Note: A negative \( AWC \) can occur if liabilities exceed assets, potentially leading to a negative \( WCTR \), which may indicate liquidity issues or efficient use of minimal working capital.

3. Importance of Working Capital Turnover Ratio Calculation

Calculating \( WCTR \) is crucial for:

- Operational Efficiency: A higher ratio suggests effective use of working capital to generate sales.

- Liquidity Management: Helps assess whether a company has sufficient working capital to cover operations.

- Financial Health: Indicates potential over- or under-investment in working capital relative to sales.

4. Using the Calculator

Example 1 (Company Alpha):

\( R = \$8,000,000 \), \( OCA = \$3,000,000 \), \( CCA = \$2,000,000 \), \( OCL = \$1,000,000 \), \( CCL = \$800,000 \):

- Step 1: \( R = \$8,000,000 \).

- Step 2: \( OCA = \$3,000,000 \), \( CCA = \$2,000,000 \).

- Step 3: \( OCL = \$1,000,000 \), \( CCL = \$800,000 \).

- Step 4: \( ACA = (3,000,000 + 2,000,000) / 2 = \$2,500,000 \), \( ACL = (1,000,000 + 800,000) / 2 = \$900,000 \).

- Step 5: \( AWC = 2,500,000 - 900,000 = \$1,600,000 \).

- Step 6: \( WCTR = 8,000,000 / 1,600,000 = 5x \).

- Results: \( ACA = \$2,500,000 \), \( ACL = \$900,000 \), \( AWC = \$1,600,000 \), \( WCTR = 5x \).

A turnover ratio of 5x indicates efficient use of working capital by Company Alpha.

Example 2:

\( R = \$6,000,000 \), \( OCA = \$1,500,000 \), \( CCA = \$1,800,000 \), \( OCL = \$700,000 \), \( CCL = \$900,000 \):

- Step 1: \( R = \$6,000,000 \).

- Step 2: \( OCA = \$1,500,000 \), \( CCA = \$1,800,000 \).

- Step 3: \( OCL = \$700,000 \), \( CCL = \$900,000 \).

- Step 4: \( ACA = (1,500,000 + 1,800,000) / 2 = \$1,650,000 \), \( ACL = (700,000 + 900,000) / 2 = \$800,000 \).

- Step 5: \( AWC = 1,650,000 - 800,000 = \$850,000 \).

- Step 6: \( WCTR = 6,000,000 / 850,000 \approx 7.06x \).

- Results: \( ACA = \$1,650,000 \), \( ACL = \$800,000 \), \( AWC = \$850,000 \), \( WCTR = 7.06x \).

A turnover ratio of 7.06x suggests strong working capital efficiency.

Example 3:

\( R = \$4,000,000 \), \( OCA = \$1,000,000 \), \( CCA = \$800,000 \), \( OCL = \$1,200,000 \), \( CCL = \$1,400,000 \):

- Step 1: \( R = \$4,000,000 \).

- Step 2: \( OCA = \$1,000,000 \), \( CCA = \$800,000 \).

- Step 3: \( OCL = \$1,200,000 \), \( CCL = \$1,400,000 \).

- Step 4: \( ACA = (1,000,000 + 800,000) / 2 = \$900,000 \), \( ACL = (1,200,000 + 1,400,000) / 2 = \$1,300,000 \).

- Step 5: \( AWC = 900,000 - 1,300,000 = -\$400,000 \).

- Step 6: \( WCTR = 4,000,000 / -400,000 = -10.00x \).

- Results: \( ACA = \$900,000 \), \( ACL = \$1,300,000 \), \( AWC = -\$400,000 \), \( WCTR = -10.00x \).

A negative turnover ratio of -10.00x indicates liabilities exceed assets, suggesting potential liquidity challenges or efficient use of minimal working capital.

5. Frequently Asked Questions (FAQ)

Q: What is the working capital turnover ratio?

A: The working capital turnover ratio (\( WCTR \)) measures how many times a company generates revenue from its average working capital in a period.

Q: Why use average working capital?

A: \( AWC \) accounts for changes in current assets and liabilities over the period, providing a more accurate efficiency measure.

Q: Can WCTR be negative?

A: Yes, a negative \( WCTR \) occurs when average working capital is negative (liabilities exceed assets), indicating potential financial strain or unique operational efficiency.

Working Capital Turnover Ratio Calculator© - All Rights Reserved 2026

Home

Home

Back

Back