1. What is the Weighted Average Cost of Capital (WACC) Calculator?

Definition: This calculator computes the Weighted Average Cost of Capital (WACC), a financial metric that represents the average rate a company pays to finance its assets, weighted by the proportion of equity and debt in its capital structure.

Purpose: Helps investors, analysts, and managers determine the cost of capital for investment decisions, valuation models (e.g., discounted cash flow), and assessing whether a company’s returns exceed its financing costs.

2. How Does the Calculator Work?

The calculator follows a five-step process to compute the WACC:

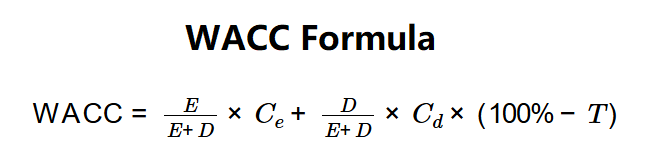

WACC Formula:

\( \text{WACC} = \frac{E}{E + D} \times C_e + \frac{D}{E + D} \times C_d \times (100\% - T) \)

Where:

- \( E \): Equity (dollars)

- \( D \): Debt (dollars)

- \( C_e \): Cost of Equity (decimal)

- \( C_d \): Cost of Debt (decimal)

- \( T \): Corporate Tax Rate (decimal)

Steps:

- Step 1: Determine equity. Obtain the total value of shareholders’ equity from the balance sheet.

- Step 2: Determine debt. Source the total debt (e.g., loans, bonds) from the balance sheet.

- Step 3: Estimate the cost of equity. Calculate or estimate the required return on equity, often using models like CAPM.

- Step 4: Check the cost of debt. Determine the interest rate or yield on the company’s debt.

- Step 5: Determine the corporate tax rate. Use the effective tax rate from financial statements, accounting for interest tax deductions.

3. Importance of WACC

Calculating the WACC is crucial for:

- Investment Evaluation: Serves as a hurdle rate to assess whether projects or investments generate returns above financing costs.

- Valuation: Used in discounted cash flow models to determine a company’s intrinsic value by discounting future cash flows.

- Capital Structure Optimization: Helps analyze the impact of equity and debt proportions on financing costs, guiding funding decisions.

4. Using the Calculator

Example: Equity = $700,000, Debt = $500,000, Cost of Equity = 15%, Cost of Debt = 8%, Corporate Tax Rate = 20%:

- Step 1: Equity: $700,000

- Step 2: Debt: $500,000

- Step 3: Cost of Equity: 15% or 0.15

- Step 4: Cost of Debt: 8% or 0.08

- Step 5: Corporate Tax Rate: 20% or 0.20

- Calculation: WACC = \( \frac{700,000}{700,000 + 500,000} \times 0.15 + \frac{500,000}{700,000 + 500,000} \times 0.08 \times (1 - 0.20) \)

- = \( 0.583 \times 0.15 + 0.417 \times 0.08 \times 0.8 = 0.0875 + 0.0267 = 0.1142 \) or 11.42%

- Result: WACC = 11.42%

A WACC of 11.42% indicates the company’s average financing cost, useful as a benchmark for investment returns.

Example 2: Equity = $1,000,000, Debt = $200,000, Cost of Equity = 12%, Cost of Debt = 6%, Corporate Tax Rate = 25%:

- Step 1: Equity: $1,000,000

- Step 2: Debt: $200,000

- Step 3: Cost of Equity: 12% or 0.12

- Step 4: Cost of Debt: 6% or 0.06

- Step 5: Corporate Tax Rate: 25% or 0.25

- Calculation: WACC = \( \frac{1,000,000}{1,000,000 + 200,000} \times 0.12 + \frac{200,000}{1,000,000 + 200,000} \times 0.06 \times (1 - 0.25) \)

- = \( 0.833 \times 0.12 + 0.167 \times 0.06 \times 0.75 = 0.09996 + 0.007515 = 0.1075 \) or 10.75%

- Result: WACC = 10.75%

A WACC of 10.75% suggests a lower financing cost due to less debt, favorable for investment evaluations.

Example 3: Equity = $500,000, Debt = $0, Cost of Equity = 10%, Cost of Debt = 0%, Corporate Tax Rate = 30%:

- Step 1: Equity: $500,000

- Step 2: Debt: $0

- Step 3: Cost of Equity: 10% or 0.10

- Step 4: Cost of Debt: 0% or 0.00

- Step 5: Corporate Tax Rate: 30% or 0.30

- Calculation: WACC = \( \frac{500,000}{500,000 + 0} \times 0.10 + \frac{0}{500,000 + 0} \times 0.00 \times (1 - 0.30) = 1 \times 0.10 + 0 = 0.10 \) or 10.00%

- Result: WACC = 10.00%

A WACC of 10% reflects a debt-free company, with financing costs equal to the cost of equity.

5. Frequently Asked Questions (FAQ)

Q: What is a good WACC?

A: A WACC of 8–12% is typical for many companies, but it varies by industry and risk profile. A lower WACC is preferable, indicating cheaper financing, but it should be compared to the company’s return on invested capital.

Q: Why does the tax rate affect WACC?

A: Interest on debt is tax-deductible, reducing the effective cost of debt. The tax shield (1 - T) lowers the debt component’s contribution to WACC, making debt financing more attractive.

Q: Can WACC be negative?

A: No, WACC is typically positive, as costs of equity and debt are positive. Negative WACC would imply unrealistic financing scenarios and requires rechecking inputs.

Weighted Average Cost of Capital (WACC) Calculator© - All Rights Reserved 2025

Home

Home

Back

Back