1. What is the Unlevered Beta Calculator?

Definition: This calculator computes the Unlevered Beta, a financial metric that measures a company’s market risk without the influence of debt, allowing for a pure assessment of its business risk.

Purpose: Helps investors and analysts evaluate a company’s inherent risk, compare risk profiles across firms with different capital structures, and use the unlevered beta in valuation models like the Capital Asset Pricing Model (CAPM).

2. How Does the Calculator Work?

The calculator follows a four-step process to compute the unlevered beta:

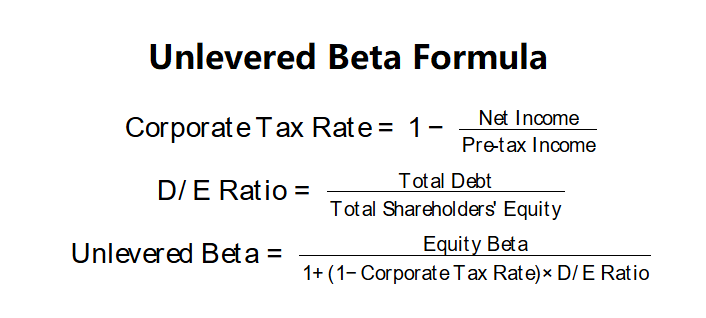

Unlevered Beta Formulas:

\( \text{Corporate Tax Rate} = 1 - \frac{\text{Net Income}}{\text{Pre-tax Income}} \)

\( \text{D/E Ratio} = \frac{\text{Total Debt}}{\text{Total Shareholders' Equity}} \)

\( \text{Unlevered Beta} = \frac{\text{Equity Beta}}{1 + (1 - \text{Corporate Tax Rate}) \times \text{D/E Ratio}} \)

Where:

- \( \text{Net Income} \): Total earnings after taxes (dollars)

- \( \text{Pre-tax Income} \): Earnings before taxes (dollars)

- \( \text{Total Debt} \): Total liabilities owed by the company (dollars)

- \( \text{Total Shareholders' Equity} \): Total equity attributable to shareholders (dollars)

- \( \text{Equity Beta} \): Levered beta reflecting market risk with debt

Steps:

- Step 1: Determine the equity beta. Obtain the levered beta from financial data providers or market analysis.

- Step 2: Calculate the corporate tax rate. Subtract the ratio of net income to pre-tax income from 1, using data from the income statement.

- Step 3: Calculate the debt-to-equity ratio. Divide total debt by total shareholders’ equity, sourced from the balance sheet.

- Step 4: Calculate the unlevered beta. Divide the equity beta by 1 plus the product of (1 minus tax rate) and the D/E ratio.

3. Importance of Unlevered Beta

Calculating the unlevered beta is crucial for:

- Risk Assessment: Provides a measure of business risk independent of debt, allowing fair comparisons across companies with varying leverage.

- Valuation Models: Used in CAPM to estimate the cost of equity for unlevered firms, aiding in discounted cash flow valuations.

- Capital Structure Analysis: Helps evaluate how debt affects a company’s risk profile, guiding financing decisions.

4. Using the Calculator

Example (Company Alpha): Net Income = $800,000, Pre-tax Income = $1,000,000, Total Debt = $12,000,000, Shareholders’ Equity = $6,000,000, Equity Beta = 1.2:

- Step 1: Equity Beta: 1.2

- Step 2: Corporate Tax Rate: \( 1 - \frac{800,000}{1,000,000} = 0.20 \) or 20%

- Step 3: D/E Ratio: \( \frac{12,000,000}{6,000,000} = 2.00 \)

- Step 4: Unlevered Beta: \( \frac{1.2}{1 + (1 - 0.20) \times 2} = \frac{1.2}{1 + 0.80 \times 2} = \frac{1.2}{2.6} = 0.4615 \)

- Result: Corporate Tax Rate = 20.00%, D/E Ratio = 2.00, Unlevered Beta = 0.4615

An unlevered beta of 0.4615 indicates Company Alpha’s business risk is lower than its levered beta, reflecting the impact of debt reduction.

Example 2: Net Income = $1,500,000, Pre-tax Income = $2,000,000, Total Debt = $5,000,000, Shareholders’ Equity = $10,000,000, Equity Beta = 1.5:

- Step 1: Equity Beta: 1.5

- Step 2: Corporate Tax Rate: \( 1 - \frac{1,500,000}{2,000,000} = 0.25 \) or 25%

- Step 3: D/E Ratio: \( \frac{5,000,000}{10,000,000} = 0.50 \)

- Step 4: Unlevered Beta: \( \frac{1.5}{1 + (1 - 0.25) \times 0.50} = \frac{1.5}{1 + 0.75 \times 0.50} = \frac{1.5}{1.375} = 1.0909 \)

- Result: Corporate Tax Rate = 25.00%, D/E Ratio = 0.50, Unlevered Beta = 1.0909

An unlevered beta of 1.0909 suggests moderate business risk, reduced from the levered beta due to lower debt levels.

Example 3: Net Income = $500,000, Pre-tax Income = $625,000, Total Debt = $0, Shareholders’ Equity = $8,000,000, Equity Beta = 1.0:

- Step 1: Equity Beta: 1.0

- Step 2: Corporate Tax Rate: \( 1 - \frac{500,000}{625,000} = 0.20 \) or 20%

- Step 3: D/E Ratio: \( \frac{0}{8,000,000} = 0.00 \)

- Step 4: Unlevered Beta: \( \frac{1.0}{1 + (1 - 0.20) \times 0.00} = \frac{1.0}{1} = 1.0000 \)

- Result: Corporate Tax Rate = 20.00%, D/E Ratio = 0.00, Unlevered Beta = 1.0000

An unlevered beta of 1.0000, equal to the equity beta, reflects no debt impact, indicating the company’s risk is purely business-related.

5. Frequently Asked Questions (FAQ)

Q: What is a good unlevered beta?

A: An unlevered beta around 1 indicates average market risk, but values vary by industry. Below 1 suggests lower risk, above 1 higher risk. Compare to industry peers for context.

Q: Why is unlevered beta lower than equity beta?

A: Unlevered beta removes the risk added by debt, which amplifies equity beta. Companies with high debt have a larger gap between levered and unlevered beta.

Q: Can unlevered beta be negative?

A: Yes, if equity beta is negative (rare, indicating inverse market movement), but negative betas are unusual and require careful interpretation.

Unlevered Beta Calculator© - All Rights Reserved 2025

Home

Home

Back

Back