Home

Home

Back

Back

Definition: The Buying Power Calculator computes the inflation-adjusted value of a dollar amount between two years, showing how the purchasing power of money changes over time due to inflation. It also compares the amount to average yearly wages to assess affordability. CPI data includes years from 1913 to May 2025.

Purpose: Helps individuals understand how inflation affects the value of money and whether their income keeps pace with rising prices, aiding in financial planning and historical comparisons.

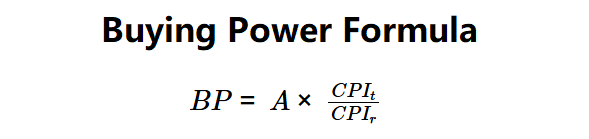

The calculator uses the Consumer Price Index (CPI) to adjust dollar amounts for inflation, following these steps and formulas:

Formulas:

Steps:

Calculating buying power is crucial for:

Example (Ford Model T): \( A = \$500 \), \( CPI_r = 9.9 \) (1913), \( CPI_t = 251.107 \) (2018), \( W_r = \$1,300 \) (1913), \( W_t = \$63,179 \) (2018):

In 1913, a Ford Model T ($500) was 38.46% of the average yearly wage ($1,300). In 2018, its equivalent value ($12,682.17) was only 20.07% of the average wage ($63,179), indicating improved affordability despite a higher nominal price ($15,000 for a basic 2018 Ford model).

Q: What is buying power?

A: Buying power is the value of a dollar amount in a target year, adjusted for inflation using CPI, reflecting how much goods or services it can buy.

Q: Why is buying power important?

A: It shows how inflation affects money’s value and helps compare affordability across time, especially relative to income.

Q: Can buying power increase over time?

A: Yes, if deflation occurs (negative inflation), but typically, inflation reduces buying power unless income grows faster than prices.