Home

Home

Back

Back

Definition: The Treynor Ratio Calculator computes the Treynor Ratio, a risk-adjusted performance metric that measures the return of a portfolio per unit of systematic risk (beta).

Purpose: It helps investors evaluate the portfolio's return relative to its market risk, aiding in comparing investments with different levels of systematic risk.

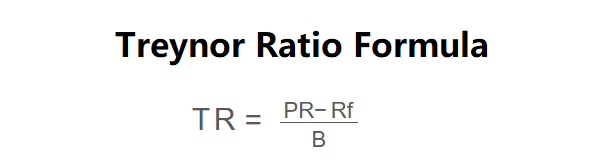

The calculator uses the following formula:

\( \text{TR} = \frac{\text{PR} - \text{Rf}}{\text{B}} \)

Where:

Steps:

Calculating the Treynor Ratio is essential for:

Example: Calculate the Treynor Ratio for Company Alpha with a beginning portfolio value of $2,000,000, ending value of $2,200,000, risk-free rate of 1.5%, and portfolio beta of 1.25:

Q: What is a good Treynor Ratio?

A: A Treynor Ratio above the market average (e.g., 5-10%) is generally considered good, depending on the industry.

Q: How is portfolio beta determined?

A: Beta is calculated as the weighted average of the betas of the portfolio's holdings, reflecting sensitivity to market movements.

Q: Can the Treynor Ratio be negative?

A: Yes, if the portfolio return is less than the risk-free rate, the Treynor Ratio will be negative.