1. What is the Total Asset Turnover Calculator?

Definition: This calculator computes the total asset turnover (\( TAT \)), which measures how efficiently a company uses its assets to generate revenue, and the average assets (\( AA \)).

Purpose: Helps businesses and investors evaluate asset utilization, assess operational efficiency, and compare performance across companies.

2. How Does the Calculator Work?

The calculator follows a three-step process to compute \( TAT \):

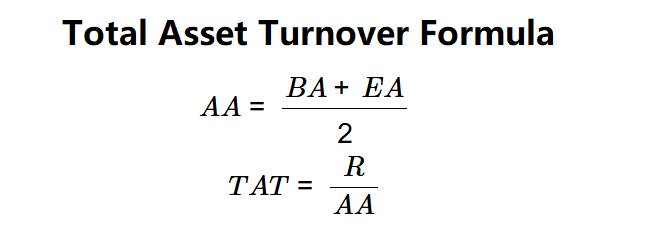

Formulas:

$$ AA = \frac{BA + EA}{2} $$

$$ TAT = \frac{R}{AA} $$

Where:

- \( TAT \): Total Asset Turnover (times)

- \( AA \): Average Assets (dollars)

- \( R \): Revenue (dollars)

- \( BA \): Beginning Assets (dollars)

- \( EA \): Ending Assets (dollars)

Steps:

- Step 1: Determine \( R \). Input the revenue from the income statement.

- Step 2: Determine \( BA \) and \( EA \). Input the beginning and ending assets from the balance sheet.

- Step 3: Calculate \( AA \). Average the beginning and ending assets.

- Step 4: Calculate \( TAT \). Divide revenue by average assets.

3. Importance of Total Asset Turnover Calculation

Calculating \( TAT \) is crucial for:

- Asset Efficiency: A higher \( TAT \) indicates effective use of assets to generate sales.

- Performance Benchmarking: Allows comparison with industry standards to assess competitiveness.

- Investment Analysis: Helps investors gauge how well a company leverages its asset base.

4. Using the Calculator

Example 1 (Company Alpha):

\( R = \$10,000,000 \), \( BA = \$8,000,000 \), \( EA = \$9,000,000 \):

- Step 1: \( R = \$10,000,000 \).

- Step 2: \( BA = \$8,000,000 \), \( EA = \$9,000,000 \).

- Step 3: \( AA = (8,000,000 + 9,000,000) / 2 = \$8,500,000 \).

- Step 4: \( TAT = 10,000,000 / 8,500,000 \approx 1.18x \).

- Results: \( AA = \$8,500,000 \), \( TAT = 1.18x \).

A total asset turnover of 1.18x indicates efficient asset use by Company Alpha.

Example 2:

\( R = \$5,000,000 \), \( BA = \$2,000,000 \), \( EA = \$3,000,000 \):

- Step 1: \( R = \$5,000,000 \).

- Step 2: \( BA = \$2,000,000 \), \( EA = \$3,000,000 \).

- Step 3: \( AA = (2,000,000 + 3,000,000) / 2 = \$2,500,000 \).

- Step 4: \( TAT = 5,000,000 / 2,500,000 = 2.00x \).

- Results: \( AA = \$2,500,000 \), \( TAT = 2.00x \).

A total asset turnover of 2.00x suggests high efficiency in asset utilization.

Example 3:

\( R = \$3,000,000 \), \( BA = \$1,500,000 \), \( EA = \$1,800,000 \):

- Step 1: \( R = \$3,000,000 \).

- Step 2: \( BA = \$1,500,000 \), \( EA = \$1,800,000 \).

- Step 3: \( AA = (1,500,000 + 1,800,000) / 2 = \$1,650,000 \).

- Step 4: \( TAT = 3,000,000 / 1,650,000 \approx 1.82x \).

- Results: \( AA = \$1,650,000 \), \( TAT = 1.82x \).

A total asset turnover of 1.82x reflects solid asset efficiency.

5. Frequently Asked Questions (FAQ)

Q: What is total asset turnover?

A: Total asset turnover (\( TAT \)) measures how many times a company’s assets are used to generate revenue in a period.

Q: Why use average assets?

A: \( AA \) accounts for changes in asset levels over the period, providing a more accurate turnover ratio.

Q: What does a low TAT indicate?

A: A low \( TAT \) may suggest underutilized assets or inefficiency in generating sales.

Total Asset Turnover Calculator© - All Rights Reserved 2026

Home

Home

Back

Back