Home

Home

Back

Back

Definition: The Time Value of Money Calculator computes the future value of a present amount, accounting for interest earned over time with compounding.

Purpose: It helps investors and financial planners determine the future worth of money, aiding in investment decisions, savings planning, and loan evaluations.

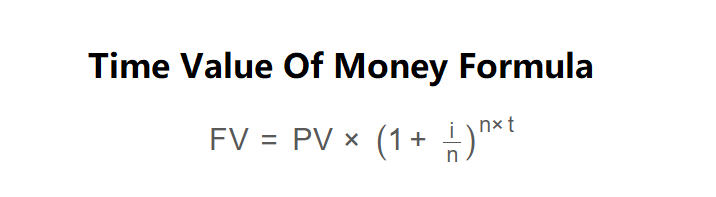

The calculator uses the following formula:

\( \text{FV} = \text{PV} \times \left(1 + \frac{\text{i}}{\text{n}}\right)^{\text{n} \times \text{t}} \)

Where:

Steps:

Calculating the time value of money is essential for:

Example: Calculate the future value of $100 over 3 years with a 5% annual interest rate compounded yearly:

Q: What is the time value of money?

A: The time value of money is the principle that money available today is worth more than the same amount in the future due to its potential earning capacity.

Q: Can the interest rate be zero?

A: Yes, a zero interest rate would result in the future value equaling the present value, adjusted only by time.

Q: What does compound frequency affect?

A: Higher compound frequency increases the future value by applying interest more often, assuming the same annual rate.