Home

Home

Back

Back

Definition: This calculator computes the taxable equivalent yield (\( TEY \)), which adjusts a tax-exempt bond’s yield to reflect its equivalent yield if it were taxable, based on the investor’s marginal tax rate.

Purpose: Helps investors compare tax-exempt bonds (e.g., municipal bonds) with taxable investments, aiding in investment decision-making.

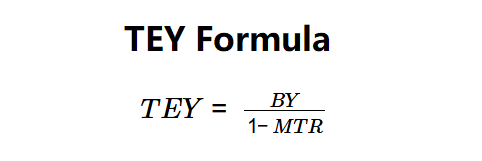

The calculator uses the following formula to compute the TEY:

Formula:

Steps:

Calculating TEY is crucial for:

Example (Bond A): \( BY = 6\% \), \( MTR = 30\% \):

A TEY of 8.571% indicates the tax-exempt 6% yield is equivalent to a 8.571% taxable yield for a 30% tax bracket investor.

Example 2: \( BY = 4\% \), \( MTR = 25\% \):

A TEY of 5.333% shows the 4% tax-exempt yield equals a 5.333% taxable yield for a 25% tax bracket.

Example 3: \( BY = 3.5\% \), \( MTR = 40\% \):

A TEY of 5.833% reflects the 3.5% tax-exempt yield’s taxable equivalent for a 40% tax bracket.

Q: What is taxable equivalent yield?

A: TEY adjusts a tax-exempt bond’s yield to its taxable equivalent, considering the investor’s tax rate.

Q: Why use marginal tax rate?

A: The marginal tax rate reflects the highest tax bracket, determining the tax savings from tax-exempt income.

Q: Can TEY be negative?

A: No, as \( BY \) and \( 1 - MTR \) are positive, TEY remains positive.