1. What is the Student Loan Calculator?

Definition: The Student Loan Calculator estimates the monthly payment, total payment, and total interest paid for a student loan, based on the loan balance, remaining term, and annual interest rate.

Purpose: This tool helps borrowers assess the affordability of student loan repayments, aiding in budgeting, loan management, and planning for early payoff or refinancing.

2. How Does the Calculator Work?

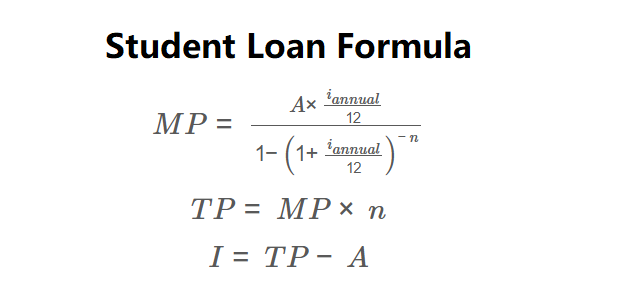

The calculator uses the following formulas:

\( MP = \frac{A \times \frac{i_{annual}}{12}}{1 - \left(1 + \frac{i_{annual}}{12}\right)^{-n}} \)

\( TP = MP \times n \)

\( I = TP - A \)

Where:

- \( MP \): Monthly payment ($);

- \( A \): Loan balance ($);

- \( i_{annual} \): Annual interest rate (decimal);

- \( n \): Remaining term (months);

- \( TP \): Total payment ($);

- \( I \): Total interest paid ($).

Steps:

- Enter the loan balance, remaining term (in months or years), and annual interest rate.

- Convert remaining term to months if entered in years.

- Calculate monthly interest rate: \( \frac{i_{annual}}{12} \).

- Calculate monthly payment using the amortization formula.

- Calculate total payment: \( TP = MP \times n \).

- Calculate total interest paid: \( I = TP - A \).

- Display results in currency format.

3. Importance of Student Loan Payment Calculation

Calculating student loan payments is essential for:

- Budget Planning: Ensures monthly payments fit within financial plans, helping manage student debt alongside other expenses.

- Cost Management: Estimates total interest paid, aiding in decisions about early repayment or refinancing to reduce costs.

- Financial Strategy: Informs choices about loan term length or income-driven repayment plans, balancing affordability and total interest.

4. Using the Calculator

Example: Calculate the payments for a $20,000 student loan with a 5% annual interest rate and a 10-year remaining term:

- Loan Balance (\( A \)): $20,000;

- Remaining Term: 10 years (\( n = 10 \times 12 = 120 \));

- Interest Rate (\( i_{annual} \)): 5% (\( \frac{0.05}{12} \approx 0.004167 \));

- Monthly Payment (\( MP \)): \( \frac{20000 \times 0.004167}{1 - (1.004167)^{-120}} \approx 211.66 \);

- Total Payment (\( TP \)): \( 211.66 \times 120 \approx 25399.20 \);

- Total Interest Paid (\( I \)): \( 25399.20 - 20000 = 5399.20 \);

- Result: Monthly Payment: $211.66; Total Payment: $25,399.20; Total Interest Paid: $5,399.20.

5. Frequently Asked Questions (FAQ)

Q: What is a student loan?

A: A student loan is a loan to cover educational expenses, repaid in installments with interest over a set term, often with flexible repayment options.

Q: How does the remaining term affect payments?

A: Longer terms reduce monthly payments but increase total interest paid, while shorter terms increase monthly payments but lower interest costs.

Q: How can I reduce total interest paid?

A: Make extra principal payments, refinance to a lower interest rate, or shorten the loan term to minimize interest costs.

Student Loan Calculator© - All Rights Reserved 2025

Home

Home

Back

Back