1. What is the Stock Profit Calculator?

Definition: This calculator computes the Profit and Return on Investment (ROI) from trading stocks, measuring the financial gain or loss after accounting for buying and selling prices and commissions.

Purpose: Helps investors evaluate the profitability of stock trades, considering transaction costs, and assess the percentage return relative to the initial investment, aiding in investment decisions.

2. How Does the Calculator Work?

The calculator follows a process to compute the stock profit and ROI:

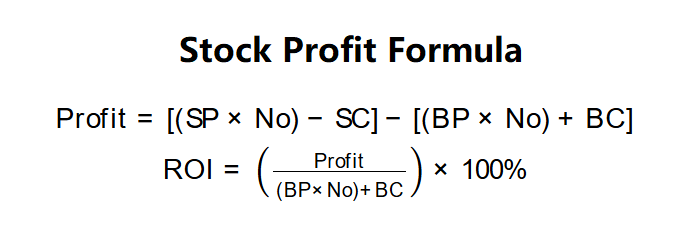

Stock Profit Formulas:

\( \text{Profit} = [(\text{SP} \times \text{No}) - \text{SC}] - [(\text{BP} \times \text{No}) + \text{BC}] \)

\( \text{ROI} = \left( \frac{\text{Profit}}{(\text{BP} \times \text{No}) + \text{BC}} \right) \times 100\% \)

Where:

- \( \text{SP} \): Selling stock price (dollars/share)

- \( \text{No} \): Number of stocks traded (stocks)

- \( \text{SC} \): Selling commission (dollars or percentage of selling value)

- \( \text{BP} \): Buying stock price (dollars/share)

- \( \text{BC} \): Buying commission (dollars or percentage of buying value)

Steps:

- Step 1: Obtain trade details. Collect the selling price, buying price, number of stocks, and commissions (fixed or percentage-based) from trade records or brokerage statements.

- Step 2: Calculate profit. Subtract selling commission from the selling value, subtract buying commission and buying value, then find the difference.

- Step 3: Calculate ROI. Divide the profit by the initial investment (buying value plus buying commission) and multiply by 100 to express as a percentage.

3. Importance of Stock Profit and ROI

Calculating stock profit and ROI is crucial for:

- Trade Evaluation: Determines the financial outcome of a stock trade, accounting for all costs, to assess whether the investment was worthwhile.

- Investment Strategy: ROI provides a percentage return, enabling comparison across different investments or trading strategies.

- Cost Awareness: Highlights the impact of commissions on profitability, encouraging cost-effective trading decisions.

4. Using the Calculator

Example: Selling Price = $50.00, Buying Price = $40.00, Number of Stocks = 100, Selling Commission = $10 (fixed), Buying Commission = $10 (fixed):

- Step 1: SP = $50.00, BP = $40.00, No = 100, SC = $10, BC = $10

- Step 2: Profit:

- \( [(50.00 \times 100) - 10] - [(40.00 \times 100) + 10] = [5000 - 10] - [4000 + 10] = 4990 - 4010 = 980 \) dollars

- Step 3: ROI:

- \( \left( \frac{980}{(40.00 \times 100) + 10} \right) \times 100 = \left( \frac{980}{4010} \right) \times 100 = 24.44\% \)

- Result: Profit = $980.00, ROI = 24.44%

A profit of $980 and ROI of 24.44% indicate a successful trade, with a significant return relative to the initial investment.

Example 2: Selling Price = $30.00, Buying Price = $25.00, Number of Stocks = 200, Selling Commission = 2% (percent), Buying Commission = 2% (percent):

- Step 1: SP = $30.00, BP = $25.00, No = 200, SC = 2%, BC = 2%

- Step 2: SC =

- \( (30.00 \times 200) \times 0.02 = 6000 \times 0.02 = 120 \) dollars,

- BC = \( (25.00 \times 200) \times 0.02 = 5000 \times 0.02 = 100 \) dollars

- Step 2: Profit:

- \( [(30.00 \times 200) - 120] - [(25.00 \times 200) + 100] = [6000 - 120] - [5000 + 100] = 5880 - 5100 = 780 \) dollars

- Step 3: ROI:

- \( \left( \frac{780}{(25.00 \times 200) + 100} \right) \times 100 = \left( \frac{780}{5100} \right) \times 100 = 15.29\% \)

- Result: Profit = $780.00, ROI = 15.29%

A profit of $780 and ROI of 15.29% suggest a moderately profitable trade, with commissions reducing the return.

Example 3: Selling Price = $20.00, Buying Price = $25.00, Number of Stocks = 50, Selling Commission = $5 (fixed), Buying Commission = $5 (fixed):

- Step 1: SP = $20.00, BP = $25.00, No = 50, SC = $5, BC = $5

- Step 2: Profit:

- \( [(20.00 \times 50) - 5] - [(25.00 \times 50) + 5] = [1000 - 5] - [1250 + 5] = 995 - 1255 = -260 \) dollars

- Step 3: ROI:

- \( \left( \frac{-260}{(25.00 \times 50) + 5} \right) \times 100 = \left( \frac{-260}{1255} \right) \times 100 = -20.72\% \)

- Result: Profit = -$260.00, ROI = -20.72%

A loss of $260 and negative ROI of -20.72% indicate an unprofitable trade, with commissions exacerbating the loss.

5. Frequently Asked Questions (FAQ)

Q: What is a good ROI for stock trading?

A: An ROI above 10–15% per trade is generally considered good, but it depends on market conditions, risk tolerance, and investment horizon. Consistent positive ROI over time is key.

Q: How do commissions affect stock profitability?

A: High commissions reduce profit and ROI, especially for small trades. Fixed commissions impact smaller trades more, while percentage-based commissions scale with trade size.

Q: Can stock profit or ROI be negative?

A: Yes, if the selling price is lower than the buying price or commissions are high, resulting in a loss and negative ROI, indicating an unprofitable trade.

Stock Profit Calculator© - All Rights Reserved 2025

Home

Home

Back

Back