Home

Home

Back

Back

Definition: The Sortino Ratio Calculator computes the Sortino Ratio, a risk-adjusted performance metric that measures the return of an investment relative to its downside risk, focusing only on negative volatility.

Purpose: It helps investors assess the return of an investment per unit of downside risk, providing a more targeted measure than the Sharpe Ratio by ignoring upward volatility.

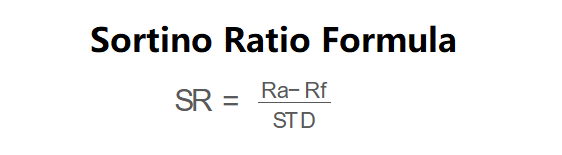

The calculator uses the following formula:

\( \text{SR} = \frac{\text{Ra} - \text{Rf}}{\text{STD}} \)

Where:

Steps:

Calculating the Sortino Ratio is essential for:

Example: Calculate the Sortino Ratio for an asset with an average return of 12%, a risk-free return of 3%, and a downside standard deviation of 10%:

Q: How is the Sortino Ratio different from the Sharpe Ratio?

A: The Sortino Ratio focuses only on downside risk (negative returns), while the Sharpe Ratio considers total volatility.

Q: What is a good Sortino Ratio?

A: A Sortino Ratio above 2 is generally considered excellent, indicating strong returns relative to downside risk.

Q: How is downside standard deviation calculated?

A: It measures the volatility of negative returns, typically derived from historical data where returns fall below a target (e.g., risk-free rate).