1. What is the Credit Spread Calculator?

Definition: This calculator computes the credit spread (\( CS \)), the difference in yield between a corporate bond and a government bond, reflecting the additional risk premium for the corporate bond.

Purpose: Helps investors evaluate the extra yield demanded for holding a corporate bond over a risk-free government bond, aiding in risk assessment.

2. How Does the Calculator Work?

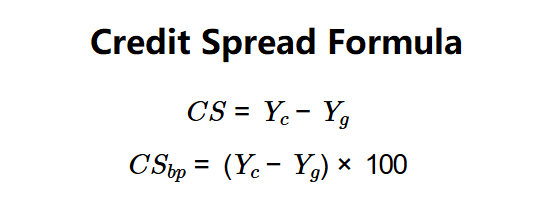

The calculator uses two formulas to compute the credit spread:

Formulas:

\( CS = Y_c - Y_g \)

\( CS_{bp} = (Y_c - Y_g) \times 100 \)

Where:

- \( CS \): Credit Spread (%)

- \( CS_{bp} \): Credit Spread (basis points)

- \( Y_c \): Corporate Bond Yield (%)

- \( Y_g \): Government Bond Yield (%)

Steps:

- Step 1: Input corporate bond yield. Provide \( Y_c \).

- Step 2: Input government bond yield. Provide \( Y_g \).

- Step 3: Calculate credit spread. Compute \( CS = Y_c - Y_g \) and convert to basis points.

3. Importance of Credit Spread Calculation

Calculating the credit spread is crucial for:

- Risk Assessment: Indicates the additional risk of a corporate bond compared to a government bond, per.

- Investment Decisions: Helps investors decide if the risk premium justifies holding the corporate bond.

4. Using the Calculator

Example 1: \( Y_c = 5.3\% \), \( Y_g = 1.8\% \):

- Step 1: \( Y_c = 5.3\% \).

- Step 2: \( Y_g = 1.8\% \).

- Step 3:

- \( CS = 5.3 - 1.8 = 3.50\% \).

- \( CS_{bp} = 3.50 \times 100 = 350 \).

- Results: \( Y_c = 5.30\% \), \( Y_g = 1.80\% \), \( CS = 3.50\% \), \( CS_{bp} = 350 \).

A credit spread of 3.50% (350 basis points) reflects the risk premium for the corporate bond.

Example 2: \( Y_c = 6.5\% \), \( Y_g = 2.0\% \):

- Step 1: \( Y_c = 6.5\% \).

- Step 2: \( Y_g = 2.0\% \).

- Step 3:

- \( CS = 6.5 - 2.0 = 4.50\% \).

- \( CS_{bp} = 4.50 \times 100 = 450 \).

- Results: \( Y_c = 6.50\% \), \( Y_g = 2.00\% \), \( CS = 4.50\% \), \( CS_{bp} = 450 \).

A higher spread of 4.50% indicates greater perceived risk.

Example 3: \( Y_c = 4.0\% \), \( Y_g = 3.0\% \):

- Step 1: \( Y_c = 4.0\% \).

- Step 2: \( Y_g = 3.0\% \).

- Step 3:

- \( CS = 4.0 - 3.0 = 1.00\% \).

- \( CS_{bp} = 1.00 \times 100 = 100 \).

- Results: \( Y_c = 4.00\% \), \( Y_g = 3.00\% \), \( CS = 1.00\% \), \( CS_{bp} = 100 \).

A narrow spread of 1.00% suggests lower risk.

5. Frequently Asked Questions (FAQ)

Q: Why is credit spread important?

A: It measures the risk premium investors demand for a corporate bond over a risk-free government bond, per Investopedia.

Q: Can credit spread be negative?

A: Rare, but possible if a corporate bond yields less than a government bond, indicating lower perceived risk, which is uncommon.

Simple Credit Spread Calculator© - All Rights Reserved 2025

Home

Home

Back

Back