Home

Home

Back

Back

Definition: The Sharpe Ratio Calculator computes the Sharpe Ratio, a measure of risk-adjusted return that evaluates an investment's performance by comparing its excess return over a risk-free rate to its standard deviation.

Purpose: It helps investors assess the return of an investment relative to its risk, aiding in portfolio optimization and comparison of investment options.

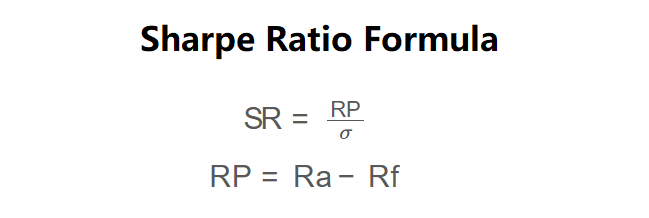

The calculator uses the following formula:

\( \text{SR} = \frac{\text{RP}}{\sigma} \)

\( \text{RP} = \text{Ra} - \text{Rf} \)

Where:

Steps:

Calculating the Sharpe Ratio is essential for:

Example: Calculate the Sharpe Ratio for an asset with a return of 12%, a risk-free return of 3%, and a standard deviation of 15%:

Q: What is a good Sharpe Ratio?

A: A Sharpe Ratio above 1 is generally considered good, indicating a favorable risk-adjusted return; above 2 is excellent.

Q: Can the Sharpe Ratio be negative?

A: Yes, if the asset return is less than the risk-free rate, the Sharpe Ratio will be negative.

Q: Why use standard deviation as risk?

A: Standard deviation measures the volatility of returns, providing a quantifiable risk metric for the Sharpe Ratio.