1. What is the Semi-Monthly Pay Calculator?

Definition: The Semi-Monthly Pay Calculator computes the semi-monthly wage (paid twice per month) and equivalent wages (hourly, daily, weekly, monthly, yearly) based on a known wage type, hours per week, and days per week.

Purpose: Helps employees, job seekers, and employers estimate semi-monthly earnings and convert between different pay periods for budgeting and payroll planning.

2. How Does the Calculator Work?

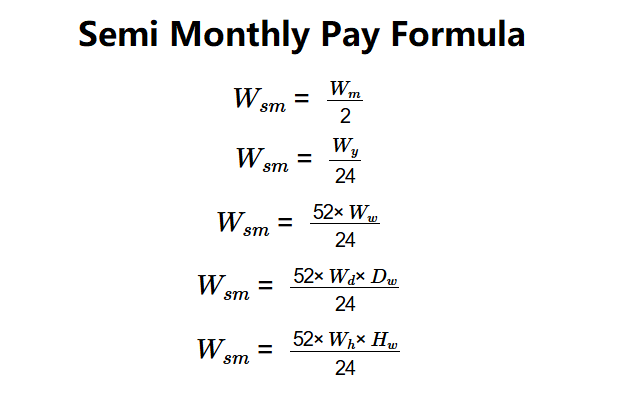

The calculator computes wages using the following formulas, assuming 24 semi-monthly pay periods per year:

Formulas:

\( W_{sm} = \frac{W_m}{2} \)

\( W_{sm} = \frac{W_y}{24} \)

\( W_{sm} = \frac{52 \times W_w}{24} \)

\( W_{sm} = \frac{52 \times W_d \times D_w}{24} \)

\( W_{sm} = \frac{52 \times W_h \times H_w}{24} \)

Where:

- \( W_{sm} \): Semi-monthly wage ($)

- \( W_m \): Monthly wage ($/month)

- \( W_y \): Yearly wage ($/year)

- \( W_w \): Weekly wage ($/week)

- \( W_d \): Daily wage ($/day)

- \( D_w \): Days per week (days)

- \( W_h \): Hourly wage ($/hour)

- \( H_w \): Hours per week (hours)

Steps:

- Step 1: Input Hours per Week. Enter the number of hours worked weekly (e.g., 40).

- Step 2: Input Days per Week. Enter the number of days worked weekly (e.g., 5).

- Step 3: Select Wage Type. Choose one of hourly, daily, weekly, monthly, or yearly wage from the dropdown.

- Step 4: Input Wage Value. Enter the known wage for the selected type.

- Step 5: Calculate Wages. Compute the semi-monthly wage and other wage types using the appropriate formulas.

3. Importance of Semi-Monthly Pay Calculation

Calculating semi-monthly pay is crucial for:

- Budgeting: Helps plan expenses based on semi-monthly income.

- Payroll Management: Assists employers in setting up semi-monthly payroll schedules.

- Financial Planning: Supports aligning savings and spending with semi-monthly pay cycles.

4. Using the Calculator

Example:

Hours per week = 40, Days per week = 5, Wage type = Hourly, Wage value = $20:

- Step 1: \( H_w \) = 40 hours.

- Step 2: \( D_w \) = 5 days.

- Step 3: Wage type = Hourly.

- Step 4: \( W_h \) = $20.

- Step 5:

- \( W_{sm} = \frac{52 \times 20 \times 40}{24} \approx 1733.33 \).

- \( W_w = \frac{1733.33 \times 24}{52} \approx 800 \).

- \( W_h = \frac{800}{40} = 20 \).

- \( W_d = \frac{800}{5} = 160 \).

- \( W_m = 1733.33 \times 2 \approx 3466.67 \).

- \( W_y = 1733.33 \times 24 \approx 41600 \).

- Result: Semi-monthly wage = $1733.33, Hourly wage = $20.00, Daily wage = $160.00, Weekly wage = $800.00, Monthly wage = $3466.67, Yearly wage = $41600.00.

This shows equivalent earnings across pay periods.

5. Frequently Asked Questions (FAQ)

Q: Why use 24 semi-monthly pay periods?

A: A year has 12 months, and semi-monthly pay occurs twice per month, resulting in 24 periods annually.

Q: How do I convert yearly wage to semi-monthly pay?

A: Divide the yearly wage by 24: \( W_{sm} = W_y / 24 \). E.g., $41,600 / 24 ≈ $1733.33.

Q: Does this include taxes?

A: This calculator provides pre-tax wages. For after-tax estimates, consult local tax regulations or use a tax calculator.

Semi-Monthly Pay Calculator© - All Rights Reserved 2025

Home

Home

Back

Back