Home

Home

Back

Back

Definition: This calculator computes the Sustainable Growth Rate (SGR), a financial metric that estimates the maximum rate at which a company can grow its revenue without requiring additional external financing, based on its retained earnings and return on equity.

Purpose: Helps investors and managers evaluate a company’s growth potential using internal resources, assess its financial strategy, and determine whether current growth plans are sustainable without increasing debt or issuing new equity.

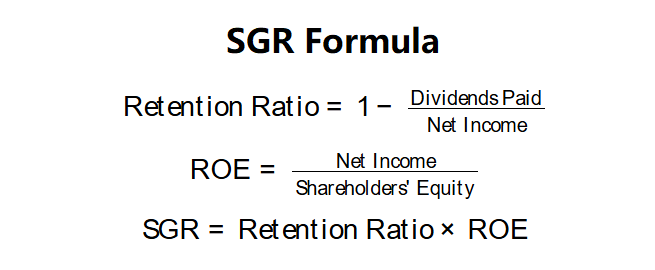

The calculator follows a three-step process to compute the SGR:

SGR Formulas:

Steps:

Calculating the SGR is crucial for:

Example (Company Alpha): Net Income = $2,000,000, Dividends Paid = $1,000,000, Shareholders’ Equity = $10,000,000:

An SGR of 10% suggests Company Alpha can grow at 10% annually without external financing, balancing reinvestment and dividends.

Example 2: Net Income = $5,000,000, Dividends Paid = $1,500,000, Shareholders’ Equity = $20,000,000:

An SGR of 17.50% indicates strong growth potential, supported by high retention and profitability.

Example 3: Net Income = $1,000,000, Dividends Paid = $800,000, Shareholders’ Equity = $15,000,000:

An SGR of 1.33% suggests limited growth potential due to high dividend payouts and low ROE.

Q: What is a good SGR?

A: An SGR of 5–15% is typically considered sustainable for most companies, but it depends on the industry and growth stage. High-growth firms may target higher SGR, while mature firms may have lower SGR.

Q: Can SGR be negative?

A: Yes, if ROE is negative (due to losses) or dividends exceed net income, but negative SGR indicates unsustainable operations or financial distress.

Q: Why is SGR important for financial planning?

A: SGR helps set realistic growth targets without relying on external financing, guiding decisions on dividends, reinvestment, and capital structure to maintain financial stability.