Home

Home

Back

Back

Definition: The Rule of 72 Calculator estimates the time required for an investment to double in value based on a constant annual growth rate, using the Rule of 72 and the actual compound interest formula.

Purpose: Helps investors and financial planners quickly estimate doubling time for investments or savings, useful for financial planning and comparison.

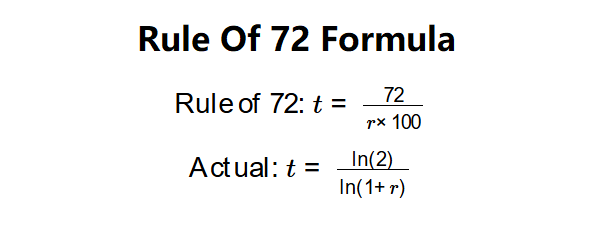

The calculator uses two methods to compute the doubling time:

Formulas:

Steps:

Calculating the doubling time is crucial for:

Example: Annual growth rate = 5%:

This shows the Rule of 72 provides a close approximation to the actual doubling time.

Q: Why use the Rule of 72?

A: The Rule of 72 is a simple, quick way to estimate doubling time without complex calculations, ideal for mental math.

Q: How accurate is the Rule of 72?

A: It’s accurate for growth rates between 1% and 20%; beyond this range, the actual formula provides better precision.

Q: Can the Rule of 72 be used for negative growth?

A: No, the Rule of 72 applies only to positive growth rates, as negative rates do not lead to doubling.