Home

Home

Back

Back

Definition: This calculator computes the marginal corporate tax rate (\( T \)) and before-tax cost of debt (\( C_b \)) based on the after-tax cost of debt (\( C_a \)), pre-tax income, and net income.

Purpose: Helps analysts and businesses derive the tax rate and cost of debt for financial modeling, capital structure analysis, or when the after-tax cost is known but the before-tax cost or tax rate is needed.

The calculator follows a two-step process to compute the results:

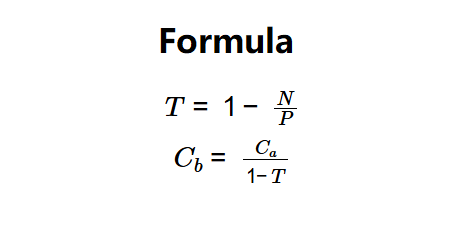

Formulas:

Steps:

Calculating \( T \) and \( C_b \) is crucial for:

Example (Bill's Brilliant Barnacles): \( C_a = 6.4\% \), \( P = \$1,000,000 \), \( N = \$800,000 \):

These results confirm the tax rate and YTM align with the company’s financial structure.

Example 2: \( C_a = 4.5\% \), \( P = \$500,000 \), \( N = \$375,000 \):

A 25% tax rate and 6% YTM suggest a moderate tax shield and borrowing cost.

Example 3: \( C_a = 7\% \), \( P = \$2,000,000 \), \( N = \$1,400,000 \):

A 30% tax rate reduces a 10% YTM to a 7% after-tax cost, reflecting a significant tax shield.

Q: Why calculate \( C_b \)?

A: \( C_b \), the YTM, is needed for WACC calculations or to compare borrowing costs with market rates for similar debt.

Q: Can \( T \) be negative?

A: No, a negative \( T \) implies \( N \) exceeds \( P \), which is invalid. Check input data for errors.

Q: What if \( C_a \) is higher than expected?

A: A high \( C_a \) may indicate a low \( T \) or high \( C_b \). Verify inputs and compare with similar companies’ debt yields.