1. What is the Retirement Calculator?

Definition: The Retirement Calculator estimates the total savings needed for retirement and the monthly savings required to achieve that goal, accounting for income needs, inflation, investment returns, and current savings.

Purpose: Helps individuals plan for retirement by determining how much to save to maintain a desired lifestyle.

2. How Does the Calculator Work?

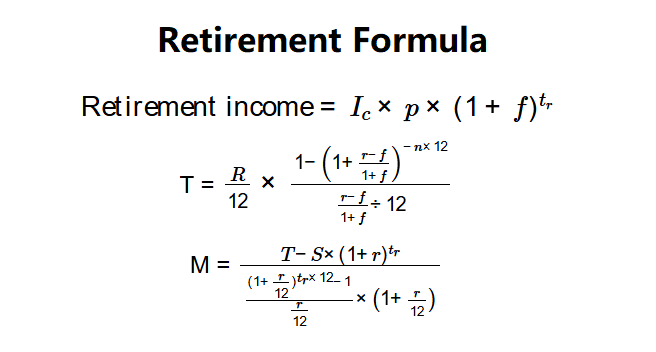

The calculator uses the following formulas to compute retirement needs and savings:

Formulas:

\( \text{Retirement income} = I_c \times p \times (1 + f)^{t_r}\)

T = \( \frac{R}{12} \times \frac{1 - \left(1 + \frac{r - f}{1 + f}\right)^{-n \times 12}}{\frac{r - f}{1 + f} \div 12}\)

M = \( \frac{T - S \times (1 + r)^{t_r}}{\frac{(1 + \frac{r}{12})^{t_r \times 12} - 1}{\frac{r}{12}} \times \left(1 + \frac{r}{12}\right)}\)

Where:

- \( I_c \): Current income ($)

- \( p \): Retirement income percentage

- \( f \): Inflation rate

- \( t_r \): Years to retirement

- \( R \): Annual retirement income ($)

- \( T \): Total savings needed at retirement ($)

- \( r \): Investment return rate

- \( n \): Years in retirement

- \( S \): Current savings ($)

- \( M \): Monthly savings required ($)

Steps:

- Step 1: Input Personal Details. Enter current age, retirement age, life expectancy, and current income (e.g., 40, 65, 85, $50,000).

- Step 2: Input Retirement Needs. Enter the percentage of current income needed in retirement (e.g., 70%).

- Step 3: Input Financial Rates. Enter investment return rate and inflation rate (e.g., 6%, 2%).

- Step 4: Input Current Savings. Enter current savings, if any (e.g., $10,000).

- Step 5: Calculate. Compute the total savings needed and monthly savings required.

3. Importance of Retirement Calculation

Calculating retirement needs is crucial for:

- Financial Security: Ensures sufficient savings to maintain lifestyle in retirement.

- Savings Planning: Guides how much to save monthly to meet retirement goals.

- Investment Strategy: Helps balance risk and return based on investment growth assumptions.

4. Using the Calculator

Example:

Current age = 40, Retirement age = 65, Life expectancy = 85, Current income = $50,000, Retirement income = 70%, Investment return = 6%, Inflation rate = 2%, Current savings = $10,000:

- Step 1: \( t_r = 65 - 40 = 25 \), \( n = 85 - 65 = 20 \).

- Step 2: \( R = 50,000 \times 0.7 \times (1 + 0.02)^{25} \approx 57,609 \).

- Step 3: Real rate = \( \frac{0.06 - 0.02}{1 + 0.02} \approx 0.0392 \), Monthly real rate = \( 0.0392 / 12 \approx 0.003267 \).

- Step 4: \( T = \frac{57,609}{12} \times \frac{1 - (1 + 0.003267)^{-20 \times 12}}{0.003267} \approx 796,947 \), Future savings = \( 10,000 \times (1 + 0.06)^{25} \approx 42,919 \), Amount needed = \( 796,947 - 42,919 = 754,028 \).

- Step 5: \( M = \frac{754,028}{\frac{(1 + \frac{0.06}{12})^{25 \times 12} - 1}{\frac{0.06}{12}} \times (1 + \frac{0.06}{12})} \approx 863.22 \).

- Result: Total needed = $796,947.00, Monthly savings = $863.22.

This shows the savings needed and monthly contributions for retirement.

5. Frequently Asked Questions (FAQ)

Q: Why adjust for inflation?

A: Inflation reduces purchasing power, so adjusting ensures the retirement income reflects future costs.

Q: What is a typical retirement income percentage?

A: A common range is 70–80% of current income, depending on lifestyle and expenses.

Q: Does this include taxes or Social Security?

A: This calculator focuses on pre-tax savings. For taxes or Social Security, consult additional resources.

Home

Home

Back

Back