Home

Home

Back

Back

Definition: This calculator computes the Retention Ratio, a financial metric that measures the percentage of net income a company retains after paying dividends to common shareholders, reflecting the portion of earnings reinvested in the business.

Purpose: Helps investors and analysts evaluate a company’s dividend policy and growth potential, as a higher retention ratio indicates more funds available for reinvestment, while a lower ratio suggests a focus on dividend payouts.

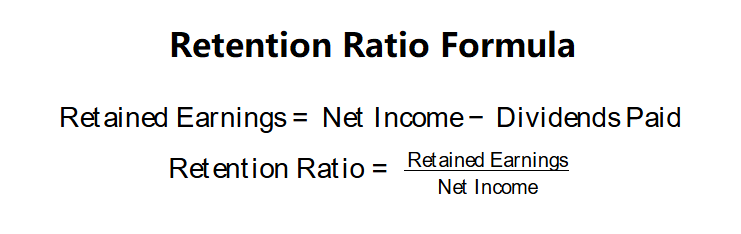

The calculator follows a two-step process to compute the retention ratio:

Retention Ratio Formulas:

Steps:

Calculating the retention ratio is crucial for:

Example (Company Alpha): Net Income = $1,000,000, Dividends Paid = $350,000:

A retention ratio of 65% indicates Company Alpha reinvests 65% of its earnings, balancing growth and dividend payouts.

Example 2: Net Income = $2,000,000, Dividends Paid = $800,000:

A retention ratio of 60% suggests the company retains a significant portion of earnings for reinvestment.

Example 3: Net Income = $500,000, Dividends Paid = $400,000:

A retention ratio of 20% indicates a strong focus on dividend payouts, with limited reinvestment.

Q: What is a good retention ratio?

A: A retention ratio between 50% and 75% is often considered balanced, supporting both growth and dividends, but it depends on the company’s strategy and industry. Growth firms may have higher ratios, while mature firms favor lower ratios.

Q: Can the retention ratio be negative?

A: Yes, if dividends exceed net income, but this is unsustainable and may indicate financial distress or reliance on reserves or debt.

Q: How does the retention ratio affect stock valuation?

A: A higher retention ratio can signal future growth potential, increasing stock value if reinvestments are effective, while a lower ratio may appeal to income investors but limit growth prospects.