1. What is the Retained Earnings Calculator?

Definition: This calculator computes retained earnings (\( RE \)), dividends distributed (\( DD \)), and retained earnings per share (\( REPS \)), which reflect the portion of net income retained by a company after dividends.

Purpose: Helps businesses and investors assess how much profit is reinvested for growth or reserved, and compare retention across companies via \( REPS \).

2. How Does the Calculator Work?

The calculator follows a four-step process to compute retained earnings metrics:

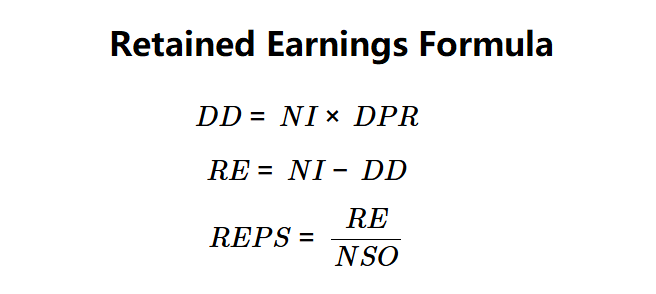

Formulas:

$$ DD = NI \times DPR $$

$$ RE = NI - DD $$

$$ REPS = \frac{RE}{NSO} $$

Where:

- \( DD \): Dividends Distributed (dollars)

- \( RE \): Retained Earnings (dollars)

- \( REPS \): Retained Earnings per Share (dollars per share)

- \( NI \): Net Income (dollars)

- \( DPR \): Dividend Payout Ratio (decimal)

- \( NSO \): Number of Shares Outstanding (shares)

Steps:

- Step 1: Determine \( NI \). Input the most recent net income from the income statement.

- Step 2: Determine \( DPR \). Input the dividend payout ratio as a percentage.

- Step 3: Calculate \( DD \). Multiply \( NI \) by \( DPR \).

- Step 4: Calculate \( RE \). Subtract \( DD \) from \( NI \).

- Step 5: Determine \( NSO \). Input the number of shares outstanding.

- Step 6: Calculate \( REPS \). Divide \( RE \) by \( NSO \).

3. Importance of Retained Earnings Calculation

Calculating retained earnings is crucial for:

- Reinvestment Strategy: Shows funds available for growth, debt reduction, or reserves.

- Shareholder Value: \( REPS \) allows comparison of retention efficiency across companies.

- Financial Stability: Indicates a company’s ability to retain profits for future use.

4. Using the Calculator

Example 1 (Company Alpha):

\( NI = \$1,000,000 \), \( DPR = 30\% \), \( NSO = 500,000 \):

- Step 1: \( NI = \$1,000,000 \).

- Step 2: \( DPR = 30\% = 0.30 \).

- Step 3: \( DD = 1,000,000 \times 0.30 = \$300,000 \).

- Step 4: \( RE = 1,000,000 - 300,000 = \$700,000 \).

- Step 5: \( NSO = 500,000 \).

- Step 6: \( REPS = 700,000 / 500,000 = \$1.40 \).

- Results: \( DD = \$300,000 \), \( RE = \$700,000 \), \( REPS = \$1.40 \).

Retained earnings of $700,000 and $1.40 per share indicate strong retention for Company Alpha.

Example 2:

\( NI = \$500,000 \), \( DPR = 20\% \), \( NSO = 250,000 \):

- Step 1: \( NI = \$500,000 \).

- Step 2: \( DPR = 20\% = 0.20 \).

- Step 3: \( DD = 500,000 \times 0.20 = \$100,000 \).

- Step 4: \( RE = 500,000 - 100,000 = \$400,000 \).

- Step 5: \( NSO = 250,000 \).

- Step 6: \( REPS = 400,000 / 250,000 = \$1.60 \).

- Results: \( DD = \$100,000 \), \( RE = \$400,000 \), \( REPS = \$1.60 \).

Retained earnings of $400,000 and $1.60 per share suggest moderate retention.

Example 3:

\( NI = \$800,000 \), \( DPR = 50\% \), \( NSO = 400,000 \):

- Step 1: \( NI = \$800,000 \).

- Step 2: \( DPR = 50\% = 0.50 \).

- Step 3: \( DD = 800,000 \times 0.50 = \$400,000 \).

- Step 4: \( RE = 800,000 - 400,000 = \$400,000 \).

- Step 5: \( NSO = 400,000 \).

- Step 6: \( REPS = 400,000 / 400,000 = \$1.00 \).

- Results: \( DD = \$400,000 \), \( RE = \$400,000 \), \( REPS = \$1.00 \).

Retained earnings of $400,000 and $1.00 per share indicate balanced dividend and retention policies.

5. Frequently Asked Questions (FAQ)

Q: What are retained earnings?

A: Retained earnings (\( RE \)) are the portion of net income kept by the company after paying dividends.

Q: How is DPR used?

A: The dividend payout ratio (\( DPR \)) determines the percentage of earnings distributed as dividends, affecting \( RE \).

Q: Can REPS be negative?

A: Yes, if net income is negative or dividends exceed earnings, \( RE \) and thus \( REPS \) can be negative.

Retained Earnings Calculator© - All Rights Reserved 2025

Home

Home

Back

Back