1. What is the Reserve Ratio and Loanable Funds Calculator?

Definition: The Reserve Ratio and Loanable Funds Calculator determines the amount of funds available for lending and the reserve ratio based on bank deposits and reserves.

Purpose: Helps bankers and economists assess liquidity and lending capacity in a fractional reserve system.

2. How Does the Calculator Work?

The calculator computes loanable funds and reserve ratio using the following formulas and steps:

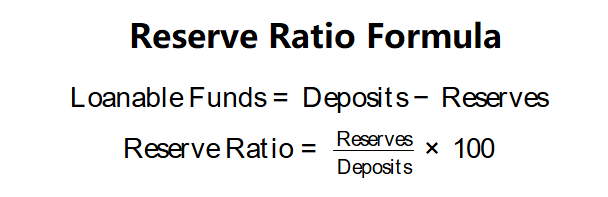

Formulas:

\( \text{Loanable Funds} = \text{Deposits} - \text{Reserves} \)

\( \text{Reserve Ratio} = \frac{\text{Reserves}}{\text{Deposits}} \times 100 \)

Where:

- \( \text{Loanable Funds} \): Amount available for lending (dollars)

- \( \text{Deposits} \): Total deposits (dollars)

- \( \text{Reserves} \): Amount held as reserves (dollars)

- \( \text{Reserve Ratio} \): Percentage of deposits held as reserves (%)

Steps:

- Step 1: Input Deposits. Enter the total amount of deposits.

- Step 2: Input Reserves. Enter the amount held as reserves.

- Step 3: Calculate Loanable Funds. Subtract reserves from deposits.

- Step 4: Calculate Reserve Ratio. Divide reserves by deposits and multiply by 100.

3. Importance of Reserve Ratio and Loanable Funds Calculation

Calculating reserve ratio and loanable funds is crucial for:

- Banking Liquidity: Ensures banks maintain adequate reserves for withdrawals.

- Loan Availability: Determines the funds available for lending to stimulate economic activity.

- Monetary Policy: Informs central bank decisions on reserve requirements.

4. Using the Calculator

Example:

Deposits = $10,000, Reserves = $1,000:

- Step 1: Deposits = $10,000.

- Step 2: Reserves = $1,000.

- Step 3: \( \text{Loanable Funds} = 10,000 - 1,000 = 9,000 \) dollars.

- Step 4: \( \text{Reserve Ratio} = \frac{1,000}{10,000} \times 100 = 10\% \).

- Results: Loanable funds = $9,000, Reserve ratio = 10%.

This indicates 90% of deposits are available for loans with a 10% reserve requirement.

5. Frequently Asked Questions (FAQ)

Q: What are loanable funds?

A: Loanable funds are the portion of deposits that banks can lend out after reserving the required amount.

Q: What happens if reserves exceed deposits?

A: This is invalid, as reserves must be less than or equal to deposits.

Q: How does the reserve ratio affect lending?

A: A higher reserve ratio reduces loanable funds, limiting money creation.

Reserve Ratio and Loanable Funds Calculator© - All Rights Reserved

Home

Home

Back

Back