Home

Home

Back

Back

Definition: The Real Rate of Return Calculator computes the real rate of return, which adjusts the nominal rate of return for inflation to reflect the actual purchasing power gained or lost on an investment.

Purpose: It helps investors understand the true value of their returns after accounting for inflation, aiding in better financial decision-making.

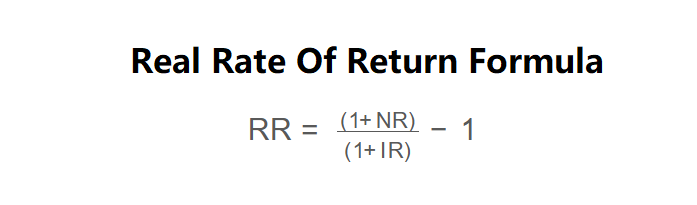

The calculator uses the following formula:

\( \text{RR} = \frac{(1 + \text{NR})}{(1 + \text{IR})} - 1 \)

Where:

Steps:

Calculating the real rate of return is essential for:

Example: Calculate the real rate of return for a nominal rate of 10% and an inflation rate of 7%:

Q: What is the difference between nominal and real rate of return?

A: The nominal rate is the unadjusted return, while the real rate adjusts for inflation to show the actual gain in purchasing power.

Q: Can the real rate of return be negative?

A: Yes, if inflation exceeds the nominal rate, the real rate can be negative, indicating a loss in purchasing power.

Q: Why use the Fisher equation?

A: The Fisher equation provides a precise adjustment for inflation, avoiding the approximation of subtracting inflation from the nominal rate directly.