Home

Home

Back

Back

Definition: The Real Interest Rate Calculator adjusts the nominal interest rate for expected inflation to reflect the true cost of borrowing.

Purpose: Helps individuals and policymakers assess the real value of interest rates in economic decisions.

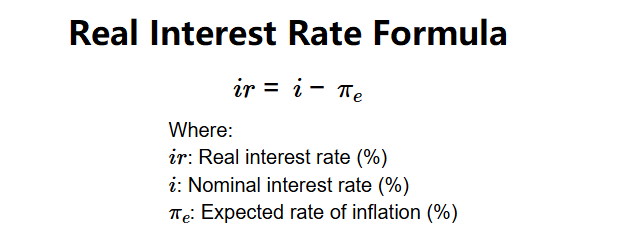

The calculator computes the real interest rate using the following formula and steps:

Formula:

Steps:

Calculating the real interest rate is crucial for:

Example: Nominal interest rate = 6%, Expected rate of inflation = 2%:

This indicates the real cost of borrowing is 4% after accounting for inflation.

Q: What is the real interest rate?

A: The real interest rate is the nominal rate adjusted for expected inflation, reflecting the true purchasing power change.

Q: What if inflation exceeds the nominal rate?

A: A negative real interest rate occurs, meaning the loan repayment is worth less in real terms.

Q: Why use expected inflation?

A: Expected inflation is used as it reflects the anticipated erosion of money's value over the loan term.