Home

Home

Back

Back

Definition: This calculator computes the Return on Sales (ROS), a financial metric that measures a company’s operating profitability by expressing its operating profit as a percentage of net sales.

Purpose: Helps investors and managers assess how efficiently a company converts sales into profits from core operations, enabling comparisons across companies or industries to evaluate operational performance.

The calculator follows a two-step process to compute the ROS:

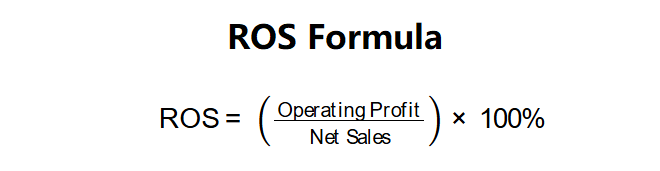

ROS Formula:

Steps:

Calculating the ROS is crucial for:

Example: Operating Profit = $2,000,000, Net Sales = $10,000,000:

An ROS of 20% suggests the company retains $0.20 in operating profit per dollar of net sales, indicating strong profitability if above industry averages.

Example 2: Operating Profit = $500,000, Net Sales = $5,000,000:

An ROS of 10% is moderate, potentially indicating average efficiency depending on industry norms.

Example 3: Operating Profit = $300,000, Net Sales = $6,000,000:

An ROS of 5% is low, suggesting limited profitability or high operating costs, which may be below industry standards.

Q: What is a good ROS?

A: An ROS of 10–20% is generally considered good, but it varies by industry. High-margin sectors like technology may have higher ROS, while retail or manufacturing may have lower ROS. Compare to industry peers for context.

Q: Can ROS be negative?

A: Yes, if operating profit is negative (e.g., due to high operating expenses or losses), indicating the company is not profitable at the operating level.

Q: How does ROS differ from net profit margin?

A: ROS focuses on operating profit, excluding non-operating income (e.g., interest or asset sales), while net profit margin includes all revenues and expenses, providing a broader profitability measure.