Home

Home

Back

Back

Definition: This calculator computes the Return on Invested Capital (ROIC), a financial metric that measures how efficiently a company uses its invested capital (equity and debt) to generate after-tax operating profits.

Purpose: Helps investors and stakeholders assess a company’s capital efficiency, compare performance across industries, and evaluate whether the company generates returns above its cost of capital, indicating value creation.

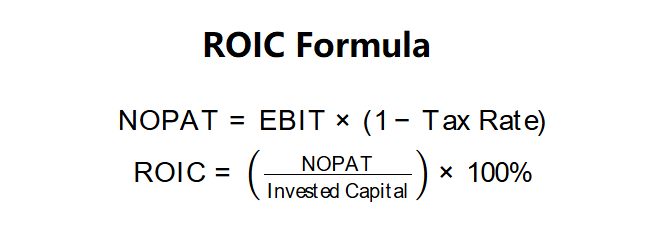

The calculator follows a three-step process to compute the ROIC:

ROIC Formulas:

Steps:

Calculating the ROIC is crucial for:

Example: EBIT = $50,000, Tax Rate = 25%, Invested Capital = $121,500:

An ROIC of 30.86% is excellent, indicating strong capital efficiency, but should be compared to industry averages and historical trends.

Example 2: EBIT = $100,000, Tax Rate = 30%, Invested Capital = $500,000:

An ROIC of 14% is solid, suggesting good capital utilization if above the company’s cost of capital.

Example 3: EBIT = $20,000, Tax Rate = 20%, Invested Capital = $200,000:

An ROIC of 8% is modest, potentially indicating inefficiency if below industry standards or the cost of capital.

Q: What is a good ROIC?

A: An ROIC above 10–15% is generally considered good, but it should exceed the company’s cost of capital and align with industry averages. High-growth industries may have higher ROIC expectations.

Q: Can ROIC be negative?

A: Yes, if NOPAT is negative (e.g., due to operating losses), indicating the company is not generating sufficient profit to cover its capital costs.

Q: Why compare ROIC to the cost of capital?

A: ROIC above the cost of capital (e.g., WACC) indicates the company creates value, while a lower ROIC suggests capital is used inefficiently, destroying value.