Home

Home

Back

Back

Definition: This calculator computes the quick ratio (\( QR \)), a liquidity metric that measures a company’s ability to meet its current liabilities with its most liquid assets, excluding inventory.

Purpose: Helps investors and creditors assess a company’s short-term financial health and ability to pay off debts without selling long-term assets.

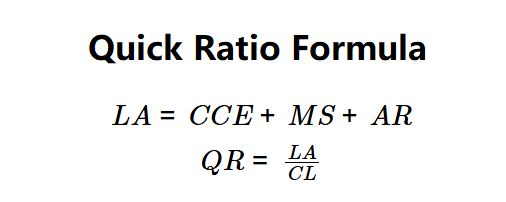

The calculator uses the following formulas to compute the quick ratio:

Formulas:

Steps:

Calculating the quick ratio is crucial for:

Example 1: \( CCE = \$50,000 \), \( MS = \$30,000 \), \( AR = \$20,000 \), \( CL = \$80,000 \):

A quick ratio of 1.25 indicates the company can cover its current liabilities 1.25 times with liquid assets.

Example 2: \( CCE = \$10,000 \), \( MS = \$5,000 \), \( AR = \$15,000 \), \( CL = \$50,000 \):

A quick ratio of 0.60 suggests the company cannot fully cover its liabilities with liquid assets, indicating potential liquidity issues.

Example 3: \( CCE = \$100,000 \), \( MS = \$50,000 \), \( AR = \$30,000 \), \( CL = \$120,000 \):

A quick ratio of 1.50 indicates strong liquidity, with a 50% buffer over liabilities.

Q: What is a good quick ratio?

A: A quick ratio above 1 is generally favorable, with 1.5–2 considered strong, though it varies by industry.

Q: Why exclude inventory?

A: Inventory may not be quickly convertible to cash at full value, making the quick ratio a stricter test of liquidity than the current ratio.

Q: Can the quick ratio be negative?

A: No, as liquid assets and current liabilities are typically positive; a ratio below 1 indicates insufficient liquidity.