Home

Home

Back

Back

Definition: The Profitability Index Calculator computes the Profitability Index (PI), a financial metric that measures a project's profitability by comparing the present value of its future discounted cash flows to the initial investment.

Purpose: It helps investors and managers evaluate the attractiveness of a project, aiding in capital budgeting decisions by indicating whether the project generates sufficient value relative to its cost.

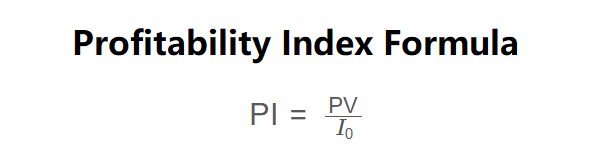

The calculator uses the following formula, as shown in the image above:

\( \text{PI} = \frac{\text{PV}}{I_0} \)

Where:

Steps:

Calculating the Profitability Index is essential for:

Example 1: Calculate the PI for a project with an initial investment of $10,000 and a present value of future cash flows of $12,000:

Example 2: Calculate the PI for a project with an initial investment of $20,000 and a present value of future cash flows of $18,000:

Q: What does a PI greater than 1 mean?

A: A PI greater than 1 indicates the project is profitable, as the present value of future cash flows exceeds the initial investment, creating value.

Q: How does PI differ from NPV?

A: PI is a ratio (PV divided by initial investment), while NPV is the absolute dollar value of the project’s net benefit (PV minus initial investment). PI is useful for comparing projects of different sizes, while NPV focuses on total value added.

Q: Can PI be negative?

A: No, since the present value of future cash flows cannot be negative, PI will always be non-negative. A PI less than 1 indicates the project is not profitable.