1. What is the Price Elasticity of Demand Calculator?

Definition: This calculator computes the price elasticity of demand (\( PED \)), which measures the responsiveness of demand to a change in price using the midpoint formula, and can solve for missing price or demand values.

Purpose: Helps businesses and economists understand how price changes affect demand, aiding in pricing strategies and revenue forecasting.

2. How Does the Calculator Work?

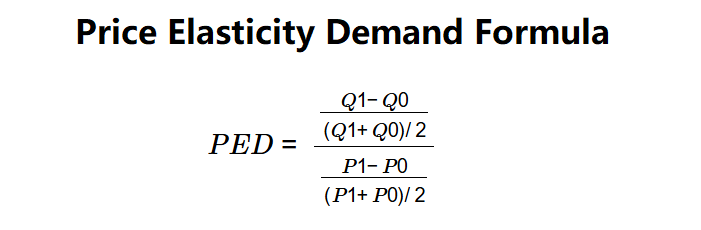

The calculator uses the midpoint formula to compute \( PED \) or solve for a missing value:

Formula:

$$ PED = \frac{\frac{Q1 - Q0}{(Q1 + Q0)/2}}{\frac{P1 - P0}{(P1 + P0)/2}} $$

Where:

- \( PED \): Price Elasticity of Demand

- \( P0 \): Initial Price (dollars)

- \( P1 \): Final Price (dollars)

- \( Q0 \): Initial Demand (units)

- \( Q1 \): Final Demand (units)

Steps:

- Step 1: Determine \( P0 \) and \( Q0 \). Input the initial price and demand.

- Step 2: Determine \( P1 \) and \( Q1 \). Input the final price and demand (optional; provide at least three values).

- Step 3: Calculate \( PED \). Use the midpoint formula if all four values are provided, or solve for the missing value if three are given.

Note: \( PED \) is typically negative due to the inverse relationship between price and demand. If solving for a missing value, the calculator assumes the midpoint elasticity holds.

3. Importance of Price Elasticity of Demand Calculation

Calculating \( PED \) is crucial for:

- Pricing Strategy: Helps set prices that balance revenue and demand sensitivity.

- Demand Forecasting: Predicts how changes in price will affect sales volume.

- Market Analysis: Identifies whether a product is elastic or inelastic based on \( PED \) magnitude.

4. Using the Calculator

Example 1 (TV Sets):

\( P0 = \$800 \), \( Q0 = 200 \), \( P1 = \$700 \), \( Q1 = 250 \):

- Step 1: \( P0 = \$800 \), \( Q0 = 200 \).

- Step 2: \( P1 = \$700 \), \( Q1 = 250 \).

- Step 3: \( PED = \frac{\frac{250 - 200}{(250 + 200)/2}}{\frac{700 - 800}{(700 + 800)/2}} = \frac{\frac{50}{225}}{\frac{-100}{750}} = \frac{0.2222}{-0.1333} \approx -1.67 \).

- Result: \( PED = -1.67 \).

A \( PED \) of -1.67 indicates relatively elastic demand for the TV sets.

Example 2 (Solve for P1):

\( P0 = \$10 \), \( Q0 = 100 \), \( Q1 = 120 \), \( PED = -1.5 \):

- Step 1: \( P0 = \$10 \), \( Q0 = 100 \).

- Step 2: \( Q1 = 120 \), \( PED = -1.5 \) (P1 missing).

- Step 3: \( -1.5 = \frac{\frac{120 - 100}{(120 + 100)/2}}{\frac{P1 - 10}{(P1 + 10)/2}} \), \( -1.5 = \frac{20/110}{(P1 - 10)/(P1 + 10)/2} \), \( -1.5 = \frac{0.1818 \times 2}{(P1 - 10)/(P1 + 10)} \), \( -3.0 = \frac{0.3636 \times (P1 + 10)}{P1 - 10} \), solve \( P1 \approx 7.27 \).

- Result: \( P1 = \$7.27 \).

A calculated \( P1 \) of $7.27 suggests a price drop to achieve the demand increase.

Example 3 (Solve for Q1):

\( P0 = \$50 \), \( P1 = \$45 \), \( Q0 = 300 \), \( PED = -2.0 \):

- Step 1: \( P0 = \$50 \), \( Q0 = 300 \).

- Step 2: \( P1 = \$45 \), \( PED = -2.0 \) (Q1 missing).

- Step 3: \( -2.0 = \frac{\frac{Q1 - 300}{(Q1 + 300)/2}}{\frac{45 - 50}{(45 + 50)/2}} \), \( -2.0 = \frac{(Q1 - 300)/(Q1 + 300)/2}{-5/47.5} \), \( -2.0 = \frac{(Q1 - 300)/(Q1 + 300) \times 2}{-0.1053} \), \( 0.2106 = \frac{Q1 - 300}{Q1 + 300} \), solve \( Q1 \approx 360 \).

- Result: \( Q1 = 360 \) units.

A calculated \( Q1 \) of 360 units indicates a demand increase with the price drop.

5. Frequently Asked Questions (FAQ)

Q: What is price elasticity of demand?

A: Price elasticity of demand (\( PED \)) measures how demand changes with price, typically negative due to inverse proportionality.

Q: Why use the midpoint formula?

A: The midpoint formula provides a balanced measure of elasticity, reducing bias from the choice of base period.

Q: Can PED be positive?

A: No, \( PED \) is almost always negative; a positive value would indicate an unusual demand behavior (e.g., Giffen goods).

Price Elasticity of Demand Calculator© - All Rights Reserved 2026

Home

Home

Back

Back