Home

Home

Back

Back

Definition: The Present Value Calculator computes the current worth of a future sum of money or cash flow, discounted at a specified rate, reflecting the time value of money.

Purpose: It helps investors and financial planners determine how much a future amount is worth today, aiding in investment decisions, loan valuations, and more.

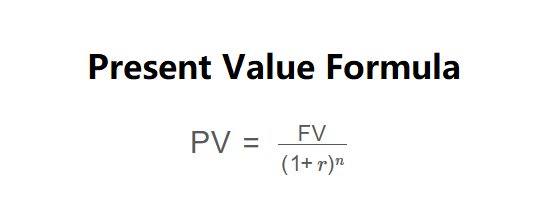

The calculator uses the following formula:

\( \text{PV} = \frac{\text{FV}}{(1 + r)^n} \)

Where:

Steps:

Calculating present value is essential for:

Example: Calculate the present value of $1,000 to be received in 5 years with a discount rate of 10%:

Q: Why is present value important?

A: It accounts for the time value of money, recognizing that money today is worth more than the same amount in the future due to its earning potential.

Q: Can the discount rate be zero?

A: A zero discount rate would make the present value equal to the future value, which is rare and typically not reflective of real-world investment scenarios.

Q: What if the future value is negative?

A: A negative future value could represent a future liability, and the present value would also be negative, indicating a current cost.