Home

Home

Back

Back

Definition: The Pre- and Post-Money Valuation Calculator computes the pre-money and post-money valuations of a company based on the investment amount and the investor's equity percentage. Pre-money valuation is the company's equity value before the investment, while post-money valuation is the value after the investment.

Purpose: It helps startups and investors determine the company's worth before and after a funding round, aiding in negotiations and understanding equity dilution.

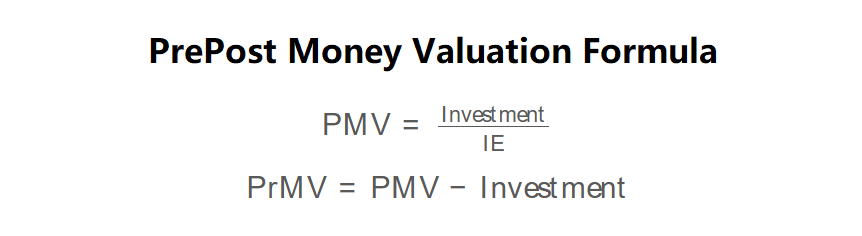

The calculator uses the following formulas, as shown in the image above:

\( \text{PMV} = \frac{\text{Investment}}{\text{IE}} \)

\( \text{PrMV} = \text{PMV} - \text{Investment} \)

Where:

Steps:

Calculating pre- and post-money valuations is essential for:

Example 1: Calculate the pre- and post-money valuations for a startup where an investor invests $25,000 for a 5% equity stake:

Example 2: Calculate the pre- and post-money valuations for a startup where an investor invests $2,500,000 for a 20% equity stake:

Q: Why is pre-money valuation smaller than post-money valuation?

A: Pre-money valuation represents the company’s value before the investment, while post-money valuation includes the additional cash from the investment, naturally increasing the company’s worth.

Q: How does investor's equity affect the valuation?

A: A higher investor's equity percentage for a given investment results in a lower post-money valuation, meaning the investor gets a larger share of a less-valued company.

Q: Can pre-money valuation be negative?

A: No, a negative pre-money valuation is not practical, as it would imply the company has a negative worth before investment, which is not feasible in this context.