Home

Home

Back

Back

Definition: The Post-Judgment Interest Calculator estimates the interest accrued on a court-awarded judgment from the judgment date to the payment (writ) date, based on the judgment amount, annual interest rate, and the time between these dates.

Purpose: This tool helps creditors calculate additional compensation for delayed payment of a judgment, ensuring they are not financially disadvantaged due to the time value of money.

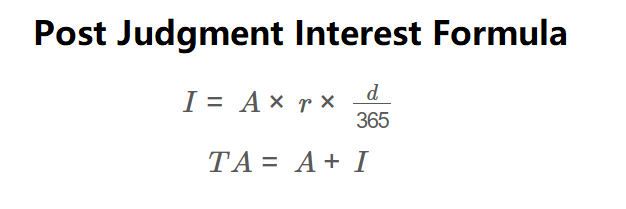

The calculator uses the following formulas:

\( I = A \times r \times \frac{d}{365} \)

\( TA = A + I \)

Where:

Steps:

Note: The interest rate is typically the weekly average 1-year constant maturity Treasury yield for federal judgments, published by the Federal Reserve.

Calculating post-judgment interest is essential for:

Example: Calculate the post-judgment interest for a $100,000 judgment with a 0.14% annual interest rate, from July 27, 2024 (judgment date) to August 24, 2024 (writ date, 28 days later):

Q: What is post-judgment interest?

A: Post-judgment interest is the interest accrued on a court-awarded judgment from the judgment date until payment, compensating for the delay in payment.

Q: Where can I find the interest rate?

A: For federal judgments, use the weekly average 1-year constant maturity Treasury yield published by the Federal Reserve for the week preceding the judgment date.

Q: Why is post-judgment interest important?

A: It ensures creditors are compensated for the time value of money, encouraging timely payment by debtors and aligning with federal statutes like 28 U.S.C. § 1961.