Home

Home

Back

Back

Definition: The Personal Loan Payment Calculator estimates the monthly payment, total payment, and total interest paid for a personal loan, based on loan amount, loan term, and annual interest rate.

Purpose: This tool helps borrowers assess the affordability of a personal loan by calculating monthly obligations and total costs, aiding in budgeting and loan comparison decisions.

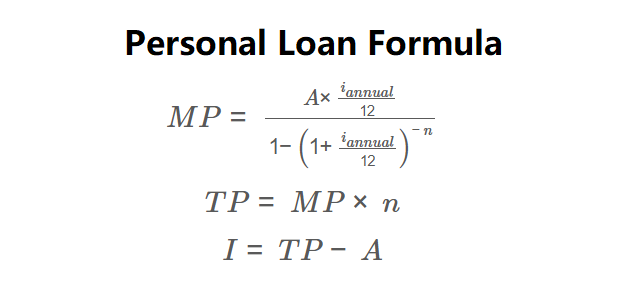

The calculator uses the following formulas:

\( MP = \frac{A \times \frac{i_{annual}}{12}}{1 - \left(1 + \frac{i_{annual}}{12}\right)^{-n}} \)

\( TP = MP \times n \)

\( I = TP - A \)

Where:

Steps:

Calculating personal loan payments is essential for:

Example: Calculate the payments for a $1,000 loan with a 5% annual interest rate and 2-year term:

Q: What is a personal loan?

A: A personal loan is an unsecured loan for personal expenses, repaid in fixed installments with interest over a set term.

Q: How does loan term affect payments?

A: Longer terms reduce monthly payments but increase total interest paid, while shorter terms increase monthly payments but lower interest costs.

Q: How can I reduce total interest paid?

A: Choose a shorter loan term, make extra principal payments, or secure a lower interest rate to minimize interest costs.