Home

Home

Back

Back

Definition: The Perpetuity Calculator computes the present value of an infinite series of equal cash flows received at regular intervals, with options for zero-growth or growing perpetuities.

Purpose: It helps investors and financial analysts value financial instruments like preferred stocks or consols, which provide perpetual payments, aiding in investment decisions.

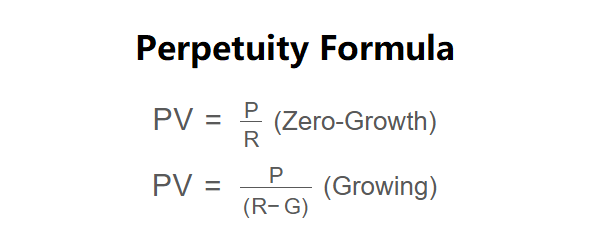

The calculator uses the following formulas:

\( \text{PV} = \frac{\text{P}}{\text{R}} \) (Zero-Growth)

\( \text{PV} = \frac{\text{P}}{(\text{R} - \text{G})} \) (Growing)

Where:

Steps:

Calculating perpetuity is essential for:

Example 1 (Zero-Growth): Calculate the present value of a perpetuity with a $1,000 annual payment and a 5% discount rate:

Example 2 (Growing): Calculate the present value with a $1,000 initial payment, 5% discount rate, and 2% growth rate:

Q: What is a perpetuity?

A: A perpetuity is a stream of equal cash flows that continues indefinitely, such as certain bonds or preferred stocks.

Q: Why must the growth rate be less than the discount rate?

A: If the growth rate equals or exceeds the discount rate, the present value becomes infinite, which is not feasible.

Q: Can perpetuities exist in practice?

A: Yes, examples include consols (redeemed in 2015) and some preferred stocks, though they are rare today.