Home

Home

Back

Back

Definition: The Percent Off Calculator computes the final price of a product after applying a percentage discount or increase, along with the amount saved, and optionally includes sales tax to provide the total cost.

Purpose: This tool helps shoppers evaluate sales deals or price increases, ensuring informed purchasing decisions by calculating final costs and savings.

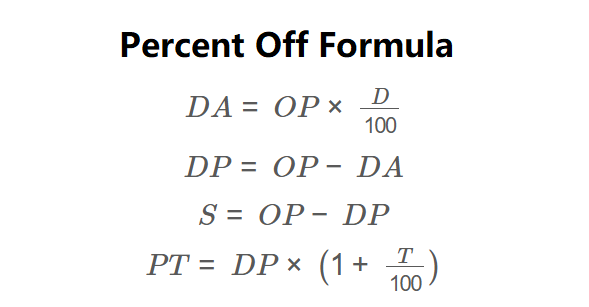

The calculator uses the following formulas:

\( DA = OP \times \frac{D}{100} \)

\( DP = OP - DA \)

\( S = OP - DP \)

\( PT = DP \times \left(1 + \frac{T}{100}\right) \)

Where:

Steps:

Calculating percent off is essential for:

Example: Calculate the discount for a $700 item with a 25% discount, including a 5% sales tax:

Q: What is a percent off discount?

A: A percent off discount is a reduction in the original price of a product or service, expressed as a percentage, such as 25% off a $700 item, resulting in a $175 reduction.

Q: Can the calculator handle price increases?

A: Yes, entering a negative discount percentage calculates the increased price and associated costs, useful for evaluating price hikes.

Q: How does sales tax affect the final price?

A: Sales tax is applied to the discounted price, increasing the final cost. This calculator includes an option to account for sales tax to provide the total amount paid.