1. What is the PMI Calculator?

Definition: This calculator computes the Private Mortgage Insurance (PMI) cost, a premium required by lenders when the down payment is less than 20% of the home purchase price, expressed as an annual and monthly amount.

Purpose: Helps homebuyers estimate PMI costs, understand loan-to-value (LTV) ratios, and plan for mortgage expenses.

2. How Does the Calculator Work?

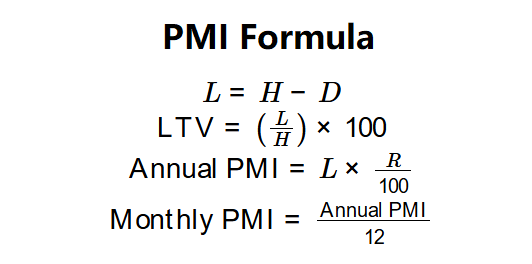

The calculator uses the following formulas:

Formulas:

\( L = H - D \)

\( \text{LTV} = \left( \frac{L}{H} \right) \times 100 \)

\( \text{Annual PMI} = L \times \frac{R}{100} \)

\( \text{Monthly PMI} = \frac{\text{Annual PMI}}{12} \)

Where:

- \( H \): Home purchase price (USD)

- \( D \): Down payment (USD)

- \( L \): Mortgage loan amount (USD)

- \( \text{LTV} \): Loan-to-value ratio (%)

- \( R \): PMI rate (%)

Steps:

- Step 1: Calculate LTV. Subtract down payment from home price to get loan amount (\( L = H - D \)), then divide by home price and multiply by 100 (\( \text{LTV} = \frac{L}{H} \times 100 \)).

- Step 2: Calculate annual PMI. Multiply loan amount by PMI rate (\( \text{Annual PMI} = L \times \frac{R}{100} \)).

- Step 3: Calculate monthly PMI. Divide annual PMI by 12 (\( \text{Monthly PMI} = \frac{\text{Annual PMI}}{12} \)).

3. Importance of PMI Calculation

Calculating PMI is key for:

- Budget Planning: Estimates additional mortgage costs when down payment is below 20%.

- Loan Comparison: Helps compare loan options based on PMI rates influenced by LTV.

- Financial Decision-Making: Assists in deciding down payment amounts to avoid or minimize PMI.

4. Using the Calculator

Example: For a home with \( H = \$100,000 \), \( D = \$12,000 \), and \( R = 1.2\% \):

- Step 1: \( L = 100,000 - 12,000 = \$88,000 \). \( \text{LTV} = \frac{88,000}{100,000} \times 100 = 88\% \).

- Step 2: \( \text{Annual PMI} = 88,000 \times \frac{1.2}{100} = \$1,056 \).

- Step 3: \( \text{Monthly PMI} = \frac{1,056}{12} = \$88 \).

- Result: Monthly PMI = \$88, Annual PMI = \$1,056, LTV = 88%.

5. Frequently Asked Questions (FAQ)

Q: How do I calculate PMI?

A: Calculate the loan amount (\( L = H - D \)), find LTV (\( \text{LTV} = \frac{L}{H} \times 100 \)), multiply loan amount by PMI rate (\( \text{Annual PMI} = L \times \frac{R}{100} \)), and divide by 12 for monthly PMI. For example, with \( H = \$100,000 \), \( D = \$12,000 \), \( R = 1.2\% \), monthly PMI = \$88.

Q: What factors affect PMI rates?

A: PMI rates depend on the LTV ratio and lender policies. Higher LTV ratios typically increase PMI rates.

Q: When is PMI required?

A: PMI is typically required when the down payment is less than 20% of the home purchase price (LTV > 80%).

Private Mortgage Insurance (PMI) Calculator© - All Rights Reserved 2025

Home

Home

Back

Back