1. What is the PITI Mortgage Calculator?

Definition: The PITI Mortgage Calculator estimates the monthly payment for a mortgage, including principal, interest, taxes, and insurance (PITI), based on the principal loan amount, annual interest rate, loan term, annual tax amount, and annual insurance cost.

Purpose: This tool helps borrowers assess the total monthly cost of homeownership, aiding in budgeting and determining mortgage affordability.

2. How Does the Calculator Work?

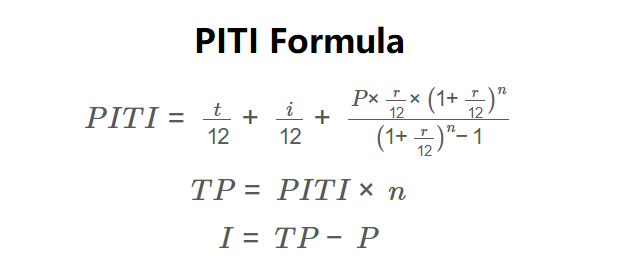

The calculator uses the following formulas:

\( PITI = \frac{t}{12} + \frac{i}{12} + \frac{P \times \frac{r}{12} \times \left(1 + \frac{r}{12}\right)^n}{\left(1 + \frac{r}{12}\right)^n - 1} \)

\( TP = PITI \times n \)

\( I = TP - P \)

Where:

- \( PITI \): Monthly PITI payment ($);

- \( t \): Annual tax amount ($);

- \( i \): Annual insurance cost ($);

- \( P \): Principal loan amount ($);

- \( r \): Annual interest rate (decimal);

- \( n \): Number of monthly repayments;

- \( TP \): Total payment ($);

- \( I \): Total interest paid ($).

Steps:

- Enter principal loan amount, annual interest rate, loan term (in years or months), annual tax amount, and annual insurance cost.

- Convert loan term to months if entered in years.

- Calculate monthly tax: \( \frac{t}{12} \).

- Calculate monthly insurance: \( \frac{i}{12} \).

- Calculate monthly principal and interest using the amortization formula.

- Calculate PITI payment: sum of monthly tax, insurance, and principal/interest.

- Calculate total payment: \( TP = PITI \times n \).

- Calculate total interest: \( I = TP - P \).

- Display results in currency format.

3. Importance of PITI Calculation

Calculating PITI payments is essential for:

- Budget Planning: Ensures monthly mortgage payments, including taxes and insurance, fit within financial plans.

- Homeownership Costs: Provides a complete picture of mortgage-related expenses, aiding in affordability assessments.

- Loan Approval: Helps lenders evaluate debt-to-income ratios, as PITI is a key factor in mortgage qualification.

4. Using the Calculator

Example: Calculate the PITI payment for a $100,000 loan with a 4% annual interest rate, 30-year term, $1,200 annual taxes, and $600 annual insurance:

- Principal (\( P \)): $100,000;

- Interest Rate (\( r \)): 4% (\( \frac{0.04}{12} \approx 0.003333 \));

- Loan Term: 30 years (\( n = 30 \times 12 = 360 \));

- Annual Tax (\( t \)): $1,200 (\( \frac{1200}{12} = 100 \));

- Annual Insurance (\( i \)): $600 (\( \frac{600}{12} = 50 \));

- Principal and Interest: \( \frac{100000 \times 0.003333 \times (1.003333)^{360}}{(1.003333)^{360} - 1} \approx 477.42 \);

- PITI Payment (\( PITI \)): \( 100 + 50 + 477.42 = 627.42 \);

- Total Payment (\( TP \)): \( 627.42 \times 360 \approx 225871.20 \);

- Total Interest (\( I \)): \( 225871.20 - 100000 = 125871.20 \);

- Result: Monthly PITI Payment: $627.42; Total Payment: $225,871.20; Total Interest Paid: $125,871.20.

5. Frequently Asked Questions (FAQ)

Q: What is PITI?

A: PITI stands for Principal, Interest, Taxes, and Insurance, representing the total monthly payment for a mortgage, including property taxes and homeowners insurance.

Q: Why include taxes and insurance in the calculation?

A: Taxes and insurance are significant homeownership costs, often escrowed by lenders, and are critical for assessing affordability and loan eligibility.

Q: How can I reduce my PITI payment?

A: Lower the loan amount, secure a lower interest rate, choose a shorter loan term (though it increases monthly payments), or reduce tax/insurance costs if possible.

PITI Mortgage Calculator© - All Rights Reserved 2025

Home

Home

Back

Back