1. What is the Overtime Paycheck Calculator?

Definition: The Overtime Paycheck Calculator computes the total pay for regular and overtime hours worked, based on regular pay rate and overtime pay multiplier.

Purpose: Helps employees and employers calculate fair compensation for work beyond standard hours, ensuring accurate payroll and budgeting.

2. How Does the Calculator Work?

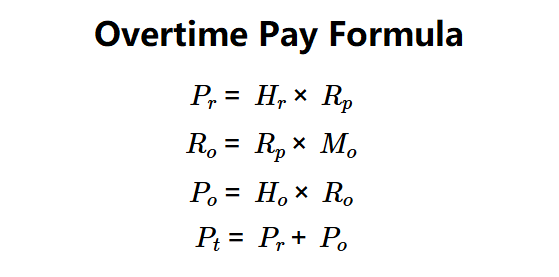

The calculator computes pays using the following formulas:

Formulas:

\( P_r = H_r \times R_p \)

\( R_o = R_p \times M_o \)

\( P_o = H_o \times R_o \)

\( P_t = P_r + P_o \)

Where:

- \( P_r \): Total regular pay ($)

- \( H_r \): Regular hours worked (hours)

- \( R_p \): Regular pay rate ($/hour)

- \( R_o \): Overtime pay rate ($/hour)

- \( M_o \): Overtime pay multiplier

- \( P_o \): Total overtime pay ($)

- \( H_o \): Overtime hours worked (hours)

- \( P_t \): Total pay ($)

Steps:

- Step 1: Input Regular Hours Worked. Enter the number of regular hours worked (e.g., 40).

- Step 2: Input Overtime Hours Worked. Enter the number of overtime hours worked (e.g., 10).

- Step 3: Input Regular Pay Rate. Enter the hourly wage for regular hours (e.g., $15).

- Step 4: Input Overtime Pay Multiplier. Enter the multiplier for overtime pay (e.g., 1.5).

- Step 5: Calculate Pays. Compute regular pay, overtime pay rate, overtime pay, and total pay using the formulas.

3. Importance of Overtime Pay Calculation

Calculating overtime pay is crucial for:

- Fair Compensation: Ensures employees are paid appropriately for extra hours worked.

- Payroll Accuracy: Helps employers accurately calculate wages for payroll processing.

- Budgeting: Assists employees in planning finances based on total earnings.

4. Using the Calculator

Example:

Regular hours = 40, Overtime hours = 10, Regular pay rate = $15, Overtime multiplier = 1.5:

- Step 1: \( H_r \) = 40 hours.

- Step 2: \( H_o \) = 10 hours.

- Step 3: \( R_p \) = $15/hour.

- Step 4: \( M_o \) = 1.5.

- Step 5:

- \( P_r = 40 \times 15 = 600 \).

- \( R_o = 15 \times 1.5 = 22.5 \).

- \( P_o = 10 \times 22.5 = 225 \).

- \( P_t = 600 + 225 = 825 \).

- Result: Total regular pay = $600.00, Overtime pay rate = $22.50/hour, Total overtime pay = $225.00, Total pay = $825.00.

This shows the total earnings including overtime compensation.

5. Frequently Asked Questions (FAQ)

Q: What is a typical overtime pay multiplier?

A: A common multiplier is 1.5 (time-and-a-half), though some regions or industries may use higher rates like 2.0 (double time).

Q: Does this calculator include taxes?

A: This calculator provides pre-tax earnings. For after-tax estimates, consult local tax regulations or use a tax calculator.

Q: Can regular and overtime hours be zero?

A: Yes, but if both are zero, the total pay will be zero. At least one type of hours is typically needed for meaningful results.

Overtime Paycheck Calculator© - All Rights Reserved 2025

Home

Home

Back

Back