1. What is the Options Spread Calculator?

Definition: This calculator computes the net debit/credit, maximum loss, maximum profit potential, breakeven price, and potential profit at expiration for bull call and bear put spread strategies.

Purpose: Assists traders in evaluating the risk and reward of vertical spread strategies, aiding in options trading decisions.

2. How Does the Calculator Work?

The calculator uses the following formulas for each spread type:

Bull Call Spread Formulas:

\( \text{NS} = (\text{P}_\text{short} - \text{P}_\text{long}) \times \text{NC} \)

\( \text{ML} = \text{NS} \times 100 \)

\( \text{MP} = [(\text{K}_\text{short} - \text{K}_\text{long}) - (\text{P}_\text{long} - \text{P}_\text{short})] \times \text{NC} \times 100 \)

\( \text{BP} = \text{K}_\text{long} + (\text{P}_\text{long} - \text{P}_\text{short}) \)

\( \text{PE} = [\min(\max(\text{S}_\text{T} - \text{K}_\text{long}, 0), \text{K}_\text{short} - \text{K}_\text{long}) - (\text{P}_\text{long} - \text{P}_\text{short})] \times \text{NC} \times 100 \)

Bear Put Spread Formulas:

\( \text{NS} = (\text{P}_\text{short} - \text{P}_\text{long}) \times \text{NC} \)

\( \text{ML} = [(\text{K}_\text{long} - \text{K}_\text{short}) - (\text{P}_\text{short} - \text{P}_\text{long})] \times \text{NC} \times 100 \times -1 \)

\( \text{MP} = \text{NS} \times 100 \)

\( \text{BP} = \text{K}_\text{short} + (\text{P}_\text{short} - \text{P}_\text{long}) \)

\( \text{PE} = [\min(\max(\text{K}_\text{long} - \text{S}_\text{T}, 0), \text{K}_\text{long} - \text{K}_\text{short}) - (\text{P}_\text{short} - \text{P}_\text{long})] \times \text{NC} \times 100 \)

Where:

- \( \text{K}_\text{long} \): Long strike price (USD)

- \( \text{P}_\text{long} \): Long premium (USD)

- \( \text{K}_\text{short} \): Short strike price (USD)

- \( \text{P}_\text{short} \): Short premium (USD)

- \( \text{NC} \): Number of contracts

- \( \text{S}_\text{T} \): Price at expiration (USD)

- \( \text{NS} \): Net spread (USD)

- \( \text{ML} \): Maximum loss (USD)

- \( \text{MP} \): Maximum profit potential (USD)

- \( \text{BP} \): Breakeven price (USD)

- \( \text{PE} \): Profit at expiration (USD)

Steps:

- Step 1: Select spread type. Choose bull call or bear put spread.

- Step 2: Input parameters. Enter long and short strike prices, premiums, number of contracts, and optional expiration price.

- Step 3: Calculate NS. Compute the net debit (bull call) or credit (bear put).

- Step 4: Calculate ML, MP, BP. Compute maximum loss, maximum profit, and breakeven price.

- Step 5: Calculate PE (if applicable). Compute profit at expiration if price at expiration is provided.

3. Importance of Options Spread Calculation

Calculating options spreads is crucial for:

- Risk Management: Defines the maximum loss and profit potential, helping traders manage exposure.

- Strategy Selection: Supports bullish (bull call) or bearish (bear put) market outlooks.

- Trade Evaluation: Enables comparison of potential outcomes at different stock prices.

4. Using the Calculator

Example 1 (Bull Call Spread): \( \text{K}_\text{long} = \$125.00 \), \( \text{P}_\text{long} = \$0.77 \), \( \text{K}_\text{short} = \$132.00 \), \( \text{P}_\text{short} = \$0.19 \), \( \text{NC} = 5 \), \( \text{S}_\text{T} = \$130.00 \):

- Step 1: Select Bull Call Spread.

- Step 2: Input \( \text{K}_\text{long} = 125.00 \), \( \text{P}_\text{long} = 0.77 \), \( \text{K}_\text{short} = 132.00 \), \( \text{P}_\text{short} = 0.19 \), \( \text{NC} = 5 \), \( \text{S}_\text{T} = 130.00 \).

- Step 3: Calculate NS: \( (0.19 - 0.77) \times 5 = -\$2.90 \).

- Step 4: Calculate ML: \( -2.90 \times 100 = -\$290.00 \).

- Step 4: Calculate MP: \( [(132.00 - 125.00) - (0.77 - 0.19)] \times 5 \times 100 = \$3210.00 \).

- Step 4: Calculate BP: \( 125.00 + (0.77 - 0.19) = \$125.58 \).

- Step 5: Calculate PE: \( [(130.00 - 125.00) - (0.77 - 0.19)] \times 5 \times 100 = \$2210.00 \).

- Results: NS = -\$2.90, ML = -\$290.00, MP = \$3210.00, BP = \$125.58, PE = \$2210.00.

This result indicates a profitable bull call spread if the stock price rises to $130.00.

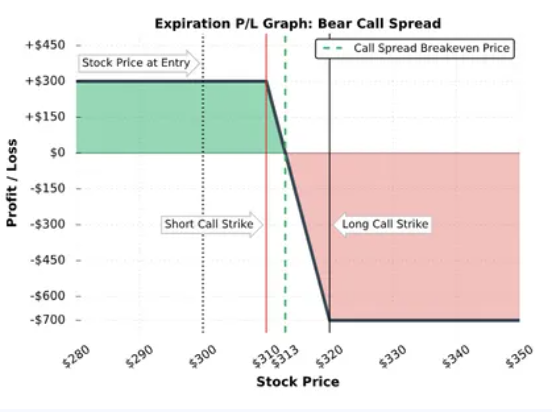

Example 2 (Bear Put Spread): \( \text{K}_\text{long} = \$320.00 \), \( \text{P}_\text{long} = \$9.65 \), \( \text{K}_\text{short} = \$310.00 \), \( \text{P}_\text{short} = \$14.35 \), \( \text{NC} = 3 \):

- Step 1: Select Bear Put Spread.

- Step 2: Input \( \text{K}_\text{long} = 320.00 \), \( \text{P}_\text{long} = 9.65 \), \( \text{K}_\text{short} = 310.00 \), \( \text{P}_\text{short} = 14.35 \), \( \text{NC} = 3 \).

- Step 3: Calculate NS: \( (14.35 - 9.65) \times 3 = \$14.10 \).

- Step 4: Calculate ML: \( [(320.00 - 310.00) - (14.35 - 9.65)] \times 3 \times 100 \times -1 = -\$1590.00 \).

- Step 4: Calculate MP: \( 14.10 \times 100 = \$1410.00 \).

- Step 4: Calculate BP: \( 310.00 + (14.35 - 9.65) = \$314.70 \).

- Results: NS = \$14.10, ML = -\$1590.00, MP = \$1410.00, BP = \$314.70.

This result shows a potential profit for a bearish strategy if the stock price falls below the breakeven price.

5. Frequently Asked Questions (FAQ)

Q: What is the difference between bull call and bear put spreads?

A: Bull call spreads are bullish, profiting from stock price increases, while bear put spreads are bearish, profiting from stock price decreases.

Q: Why is the maximum loss limited?

A: Vertical spreads involve both buying and selling options, capping the risk to the net debit (bull call) or the spread width minus net credit (bear put).

Q: How do I find option premiums?

A: Option premiums are available from brokerage platforms or financial data providers, reflecting current market prices.

Options Spread Calculator© - All Rights Reserved 2025

Home

Home

Back

Back