1. What is the Optimal Hedge Ratio Calculator?

Definition: The Optimal Hedge Ratio Calculator computes the optimal hedge ratio, a metric that determines the ideal proportion of a portfolio to hedge using futures contracts to minimize risk.

Purpose: It helps investors and portfolio managers optimize hedging strategies by balancing risk reduction and potential profits, particularly in volatile markets.

2. How Does the Calculator Work?

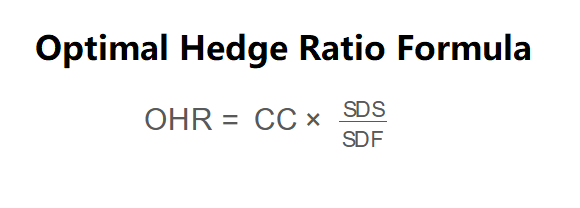

The calculator uses the following formula:

\( \text{OHR} = \text{CC} \times \frac{\text{SDS}}{\text{SDF}} \)

Where:

- \( \text{OHR} \): Optimal Hedge Ratio;

- \( \text{CC} \): Correlation Coefficient (no restriction);

- \( \text{SDS} \): Standard Deviation of Spot Price;

- \( \text{SDF} \): Standard Deviation of Futures Price.

Steps:

- Enter the correlation coefficient between spot and futures price changes.

- Enter the standard deviation of the spot price.

- Enter the standard deviation of the futures price.

- Calculate the optimal hedge ratio using the formula above.

- Display the result, formatted in scientific notation if the absolute value is less than 0.001, otherwise with 4 decimal places.

3. Importance of Optimal Hedge Ratio Calculation

Calculating the optimal hedge ratio is essential for:

- Risk Management: Minimizes portfolio variance and reduces exposure to price fluctuations.

- Cost Efficiency: Helps avoid over- or under-hedging, optimizing hedging costs.

- Portfolio Optimization: Assists in designing strategies that balance risk and reward.

4. Using the Calculator

Example: Calculate the optimal hedge ratio for Portfolio Alpha with a correlation coefficient of 0.83, standard deviation of spot price of 0.05, and standard deviation of futures price of 0.072:

- \( \text{CC} \): 0.83;

- \( \text{SDS} \): 0.05;

- \( \text{SDF} \): 0.072;

- \( \text{OHR} \): \( 0.83 \times \frac{0.05}{0.072} \approx 0.5764 \).

5. Frequently Asked Questions (FAQ)

Q: Can the optimal hedge ratio be negative?

A

Home

Home

Back

Back