Home

Home

Back

Back

Definition: This calculator computes the Operating Cash Flow (OCF) Ratio, a liquidity metric that measures how well a company’s cash flow from operations covers its current liabilities over the past twelve months (TTM).

Purpose: Helps investors and analysts assess a company’s short-term financial health and ability to meet obligations without relying on external financing.[](https://www.omnicalculator.com/finance/operating-cash-flow-ratio)

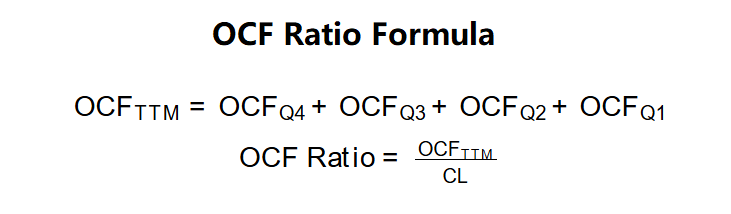

The calculator uses the Trailing Twelve Months (TTM) operating cash flow to compute the OCF ratio:

OCF Ratio Formulas:

Steps:

Calculating the OCF ratio is crucial for:

Example (Walmart, Feb 2019): OCFQ4 = $7,000,000,000, OCFQ3 = $6,800,000,000, OCFQ2 = $7,100,000,000, OCFQ1 = $6,900,000,000, CL = $77,500,000,000:

This indicates Walmart’s operating cash flow covers 36% of its current liabilities, suggesting moderate liquidity.

[](https://www.investopedia.com/terms/o/ocfratio.asp)Example 2: OCFQ4 = $2,500,000, OCFQ3 = $2,300,000, OCFQ2 = $2,400,000, OCFQ1 = $2,200,000, CL = $5,000,000:

This suggests the company can cover its liabilities 1.88 times, indicating strong liquidity.

Example 3: OCFQ4 = $1,000,000, OCFQ3 = $900,000, OCFQ2 = $950,000, OCFQ1 = $850,000, CL = $4,000,000:

This indicates the company falls short of covering its liabilities, suggesting potential liquidity concerns.

Q: What is a good OCF ratio?

A: A ratio greater than 1 indicates the company can cover its current liabilities with operating cash flow, suggesting good liquidity. Ratios below 1 may signal financial strain, though context (e.g., industry norms) matters.[](https://corporatefinanceinstitute.com/resources/accounting/operating-cash-flow-ratio/)

Q: Why use TTM for OCF?

A: TTM accounts for a full year’s cash flow, aligning with the balance sheet’s snapshot of current liabilities, providing a more accurate liquidity measure than single-quarter data.[](https://www.omnicalculator.com/finance/operating-cash-flow-ratio)

Q: How does the OCF ratio differ from the current ratio?

A: The OCF ratio uses cash flow from operations, focusing on actual cash generated, while the current ratio uses current assets, which may include non-liquid items.[](https://www.investopedia.com/terms/o/ocfratio.asp)