Home

Home

Back

Back

Definition: The Operating Asset Turnover Calculator computes the operating asset turnover ratio, a financial metric that measures how efficiently a company uses its operating assets to generate sales. It is calculated by dividing sales (revenue) by the total operating assets.

Purpose: It helps businesses evaluate the efficiency of asset utilization in generating revenue, providing insights into operational performance. A higher ratio indicates better efficiency in using assets to produce sales.

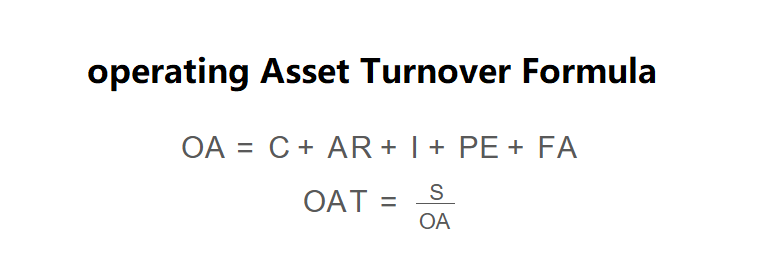

The calculator follows these steps, using the formulas shown in the image above:

\( \text{OA} = \text{C} + \text{AR} + \text{I} + \text{PE} + \text{FA} \)

\( \text{OAT} = \frac{\text{S}}{\text{OA}} \)

Where:

Steps:

Calculating the operating asset turnover is essential for:

Example 1: Calculate the operating asset turnover for Company Alpha with the following values: cash = $250,000, accounts receivable = $200,000, inventory = $400,000, prepaid expenses = $100,000, fixed assets = $1,000,000, and sales = $3,000,000:

Example 2: Calculate the operating asset turnover for a company with cash = $100,000, accounts receivable = $150,000, inventory = $200,000, prepaid expenses = $50,000, fixed assets = $500,000, and sales = $1,200,000:

Q: What does a high operating asset turnover ratio indicate?

A: A high ratio suggests that a company efficiently uses its operating assets to generate sales, indicating strong operational performance.

Q: How does operating asset turnover differ from total asset turnover?

A: Operating asset turnover focuses only on assets used in operations (e.g., excluding investments), while total asset turnover considers all assets, providing a broader efficiency measure.

Q: How can a company improve its operating asset turnover?

A: A company can improve this ratio by increasing sales through better marketing, reducing excess inventory, optimizing receivables collection, or streamlining operations to reduce asset needs.