1. What is the Net to Gross Calculator?

Definition: The Net to Gross Calculator computes the gross amount, tax amount, and percentage tax (from gross) given the net amount and percentage tax (from net), applicable to scenarios like VAT/sales tax or income tax calculations.

Purpose: Helps individuals and businesses determine the gross amount before tax deductions or after tax additions, aiding in budgeting, financial planning, and contract negotiations.

2. How Does the Calculator Work?

The calculator computes the required values using the following formulas and steps:

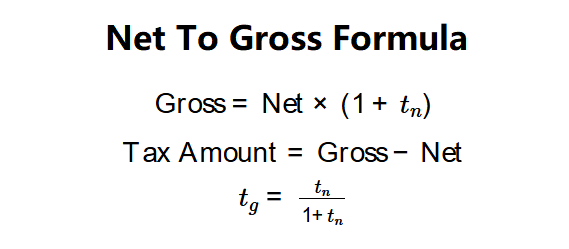

Formulas:

\( \text{Gross} = \text{Net} \times (1 + t_n) \)

\( \text{Tax Amount} = \text{Gross} - \text{Net} \)

\( t_g = \frac{t_n}{1 + t_n} \)

Where:

- \( \text{Net} \): Amount before tax addition (e.g., price without VAT) or after tax deduction (e.g., take-home pay) (dollars)

- \( \text{Gross} \): Amount after tax addition (e.g., total price with VAT/sales tax) or before tax deduction (e.g., gross income) (dollars)

- \( t_n \): Percentage tax from net (decimal)

- \( t_g \): Percentage tax from gross (decimal)

- \( \text{Tax Amount} \): Difference between gross and net (dollars)

Steps:

- Step 1: Input Net Amount. Enter the amount before tax addition or after tax deduction.

- Step 2: Input Percentage Tax (from Net). Enter the tax rate as a percentage of the net amount.

- Step 3: Calculate Gross Amount. Multiply net amount by (1 + tax from net).

- Step 4: Calculate Tax Amount. Subtract net amount from gross amount.

- Step 5: Calculate Percentage Tax (from Gross). Divide tax from net by (1 + tax from net).

3. Importance of Net to Gross Calculation

Calculating net to gross is crucial for:

- Financial Planning: Understand the total cost or gross pay needed to achieve a desired net amount after taxes.

- Budgeting: Plan expenses or salary negotiations based on gross amounts.

- Tax Compliance: Accurately calculate taxes like VAT, sales tax, or FICA (6.2% Social Security + 1.45% Medicare, or 15.3% for self-employed).

4. Using the Calculator

Example:

Net amount = $80, Percentage tax (from net) = 25%:

- Step 1: Net amount = $80.

- Step 2: Percentage tax (from net) = 25% = 0.25.

- Step 3: \( \text{Gross} = 80 \times (1 + 0.25) = 80 \times 1.25 = 100 \) dollars.

- Step 4: \( \text{Tax Amount} = 100 - 80 = 20 \) dollars.

- Step 5: \( t_g = \frac{0.25}{1 + 0.25} = \frac{0.25}{1.25} = 0.2 = 20\% \).

- Results: Gross amount = $100, Percentage tax (from gross) = 20%, Tax Amount = $20.

This shows an $80 net amount with a 25% tax from net results in a $100 gross amount and $20 tax.

5. Frequently Asked Questions (FAQ)

Q: What is the difference between net and gross?

A: Net excludes taxes (e.g., price without VAT or take-home pay), while gross includes taxes (e.g., total price with VAT or income before tax).

Q: How does percentage tax (from net) differ from percentage tax (from gross)?

A: Tax from net is the tax rate applied to the net amount to get the gross amount, while tax from gross is the tax rate applied to the gross amount to get the net amount. They are related by \( t_g = \frac{t_n}{1 + t_n} \).

Q: Can this calculator be used for income taxes like FICA?

A: Yes, it can calculate gross pay before FICA taxes (6.2% Social Security + 1.45% Medicare, or 15.3% for self-employed) by treating the tax rate as tax from net.

Home

Home

Back

Back