Home

Home

Back

Back

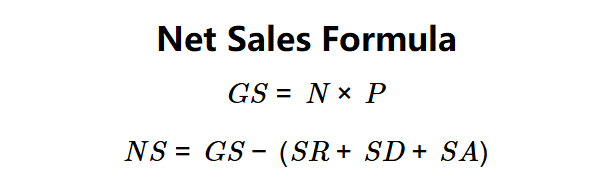

Definition: This calculator computes net sales (\( NS \)), which represents the actual revenue after deducting sales returns, allowances, and discounts from gross sales (\( GS \)).

Purpose: Helps businesses assess true sales performance, manage returns and discounts, and improve financial reporting accuracy.

The calculator follows a two-step process to compute \( NS \):

Formulas:

Steps:

Note: Gross sales reflect total sales before adjustments, while net sales provide the actual revenue after accounting for returns, discounts, and allowances.

Calculating \( NS \) is crucial for:

Example 1 (Notebooks): \( N = 100 \), \( P = \$200 \), \( SR = 5 \times \$200 = \$1,000 \), \( SD = \$500 \), \( SA = \$300 \):

Net sales of $18,200 reflect the adjusted revenue after returns and discounts.

Example 2: \( N = 50 \), \( P = \$100 \), \( SR = \$200 \), \( SD = \$100 \), \( SA = \$50 \):

Net sales of $4,650 indicate a modest deduction from gross sales.

Example 3: \( N = 200 \), \( P = \$50 \), \( SR = \$1,000 \), \( SD = \$300 \), \( SA = \$200 \):

Net sales of $8,500 show a significant adjustment due to returns and allowances.

Q: What is net sales?

A: Net sales (\( NS \)) is the revenue remaining after subtracting sales returns, allowances, and discounts from gross sales.

Q: How does sales returns affect net sales?

A: Sales returns reduce \( NS \) by the value of returned goods, reflecting actual sales revenue.

Q: Can net sales be negative?

A: No, \( NS \) cannot be negative if gross sales exceed deductions, but it can be zero if returns and adjustments equal gross sales.